The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:00 am

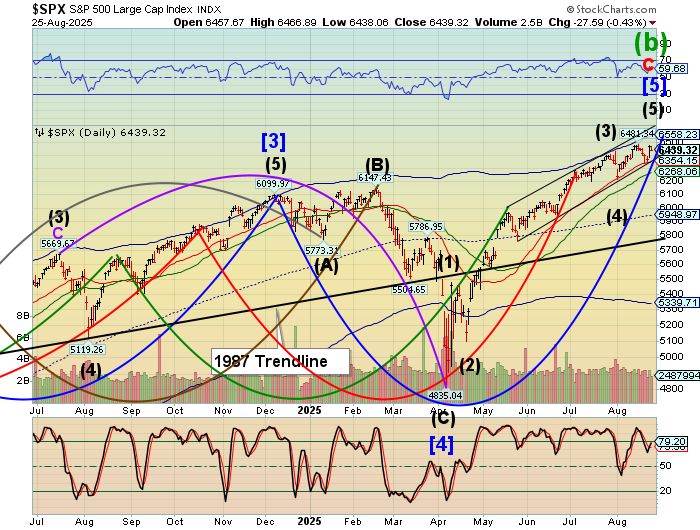

SPX futures declined to 6415.50 overnight before a small bounce. While today is day 263 (of an average 258 days), the fractal structure may not yet be complete. The final probe to a new ATH may take the SPX between 6500.00 and 6558.00. A move of that dimension may trigger the final sidelined investors to “buy the dip” to their ultimate dismay. This move may drain any liquidity left on the sidelines, causing a “no bid” situation in the ensuing decline. The Cycles Model calls for a decline lasting to the end of September, cementing its reputation is the most bearish month.

Today’s options chain shows Max Pain at 6450.00. Long gamma may strengthen above 6500.00 while short gamma begins in earnest beneath 6445.00.

ZeroHedge reports, “US equity futures are a tad lower as the yield curve twists steeper with 5Y yields flat, after Trump moves to fire the Fed’s Cook, sending the USD is weaker. A showdown looms with Cook saying that Trump has no authority to oust her and that she will not quit (previously the SCOTUS indicated that the Fed Governors could not be fired at-will but if it does decide that Trump fired her for cause, Powell would be responsible if he keeps her on after Trump has sacked her). As of 8:15am, S&P and Nasdaq futures are down 0.2% even with Nvidia rising 0.5% ahead of its results on Wednesday. In premarket trading, semis are higher with Defensive sectors outperforming Cyclicals; large-cap Industrials are in the green. In Europe, major markets are all lower with France the biggest laggard on fears of gov’t stability; Germany and UK the relative areas of safety. Commodities are weaker, dragged by Energy. Key events today include the August Philadelphia Fed non-manufacturing index and July preliminary durable goods orders (8:30 a.m.), June FHFA house price index and S&P CoreLogic home price indexes (9 a.m.), August Richmond Fed manufacturing and business conditions indexes and Conference Board consumer confidence (10 a.m.). All eyes on Nvidia earnings tomorrow.”

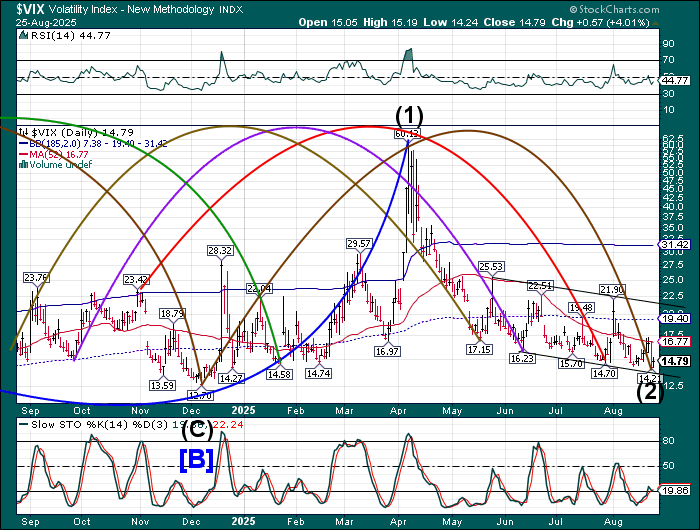

VIX futures rose to 15.75 this morning as it pulls away from a possible Master Cycle low made last Friday. An alternate view may infer a final probe lower. The Cycles Model suggests a spike in volatility on Wednesday that may complete the fractal.

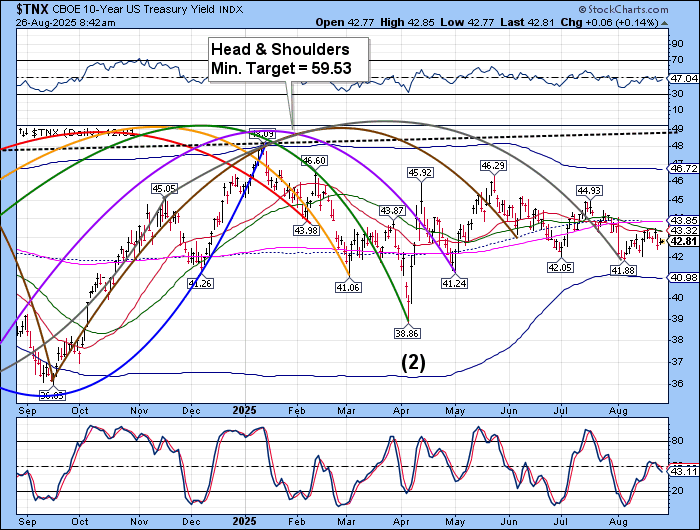

TNX futures continue to consolidate in line. A study of the Cycles Model reveals a possible scenario that has legs. That is, TNX may hold steady or possibly decline for yet another month as stocks decline. The 10-year Treasury Note appears bullish during that same period. It is possible that TNX may reach its April 7 low.

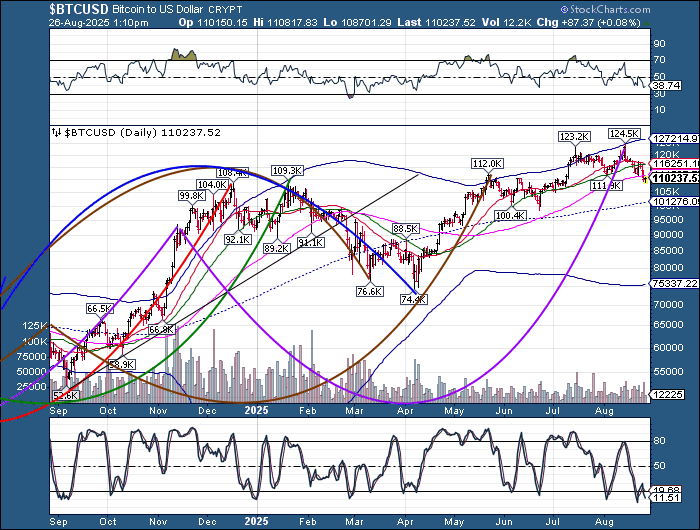

Bitcoin has fallen beneath its 100-day Moving Average with a week to go in the current Master Cycle. The highest probability target for this decline may be the mid-Cycle support at 101275.80. However, there may be a spike in volatility by the weekend that could affect the ultimate goal.

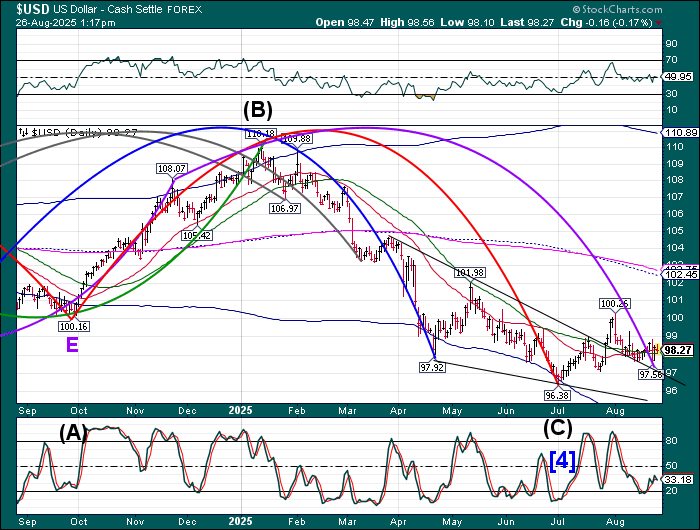

USD futures remain above the 50-day Moving Average at 98.10 today. It may be on a sell signal, but awaits confirmation with a close above the Intermediate support/resistance at 98.30. The Cycles Model calls for a rally to mid-September with a possible extension.