The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:30 am

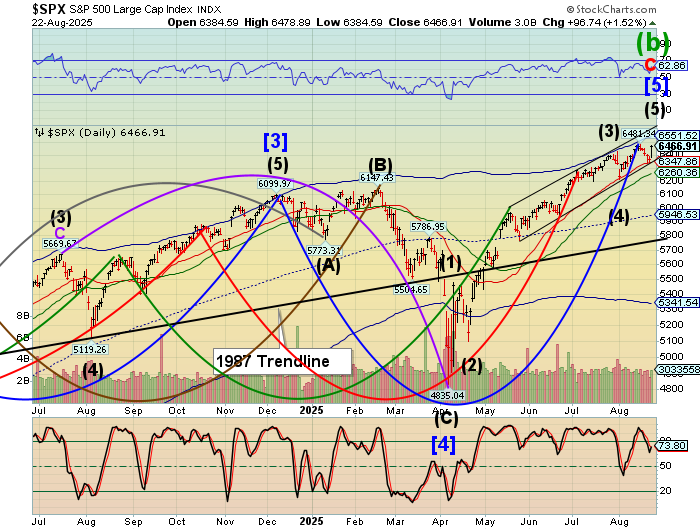

SPX futures have pulled back to 6446.00 this morning as it consolidates prior to another probe toward 6500.00 to 6552.00. The current Master Cycle is extending on day 262 and may consume some or all of this week to complete its fractal. The SPX may explore new highs with volume and volatility to bring in the last holdout to the party as it sucks the liquidity dry, leaving no one to buy the dip. The Labor Day weekend is typically a seasonal high point before September comes crashing down. The ensuing decline may take the entire month to complete with the April 7 low as the possible target.

Today’s options chain shows Max Pain at 6455.00. Long gamma may begin above 6470.00, while short gamma appears beneath 6420.00.

ZeroHedge reports, “Markets are mixed this morning, with US stock futures ticking lower as euphoria over the prospect of a Fed rate cut fizzling out after Friday’s rally. Attention turns to one of the biggest market tests ahead of the central bank’s September policy meeting: Wednesday’s Nvidia earnings. As of 8:15am, S&P futures are down 0.3% after the best day since May and the index finishing the week 2pts below its all time high. Media are pointing to a lack of Fed consensus to cut based on comments from Goolsbee / Musalem. Pre-market Mag7 names are all lower with Defensives outperforming Cyclicals, reversing some of the gains from Friday. Intel shares rose in premarket trading after the US agreed to take a 10% stake in the chip maker. The yield curve is bear steepening and the USD is strengthening. Commodities are rallying led by Energy. The keys this week are NVDA earnings but also a number of macro data releases that can clarify the US econ growth situation, e.g., Durable / Cap Goods, Consumer Confidence, regional Fed activity indicators, jobless data, PCE, and Personal Income / Spending.Looking at today’s calendar, we get new home sales and Dallas Fed manufacturing index. Fed Voter Williams and non-voter Logan are also scheduled to speak.”

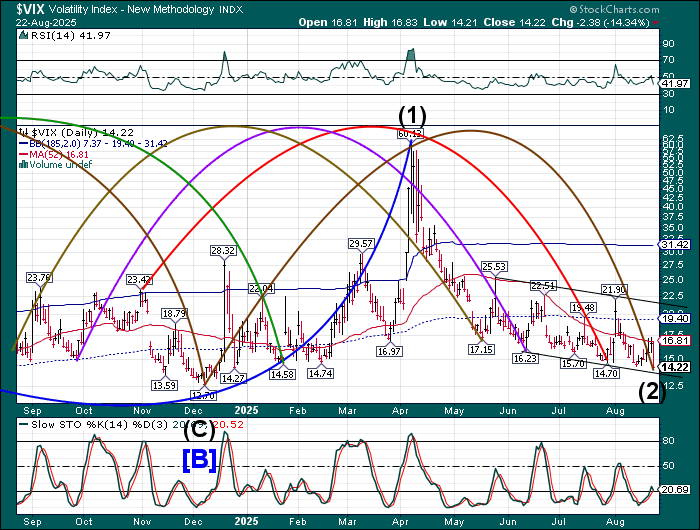

VIX futures are consolidating near Friday’s low. The proposed Master Cycle may also be extended this week. Any semblance of calm may be destroyed once the reversal is in. The Cycles Model suggests Wednesday as a high volatility day and a possible reversal.

The August 27 options chain shows Max Pain at 16.00. Short gamma is taking on a diminished role under 15.00 while long gamma rules above 18.00.

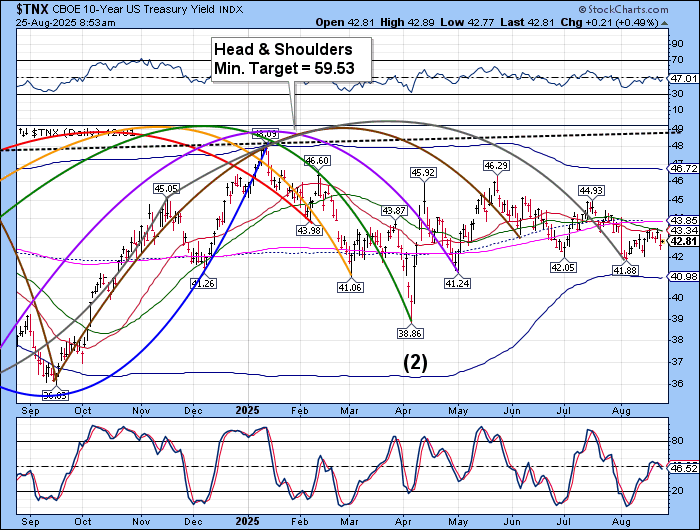

TNX is approaching the final days in which it may make a low near the Cycle Bottom at 40.98. It remains in a shallow decline that may be conducive to a further decline to Bottom Support. Unfortunately, more and more home buyers are financing their purchases with adjustable rate mortgages, expecting long-term rates to decline. The Cycles Model says that the opposite may be true. This may be a disaster waiting to happen.

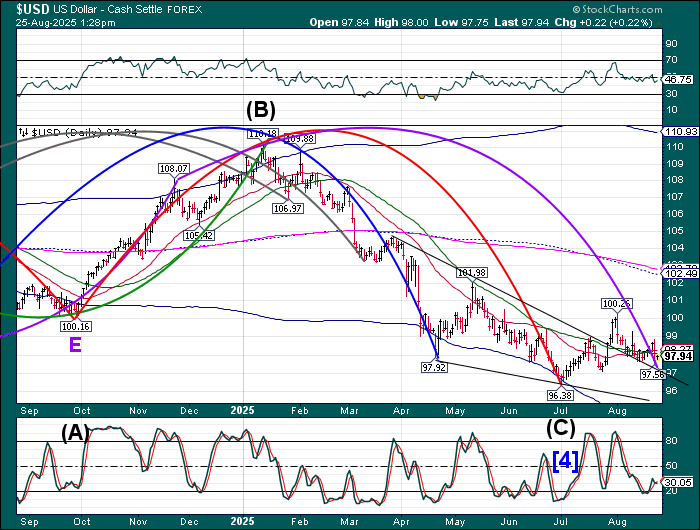

USD futures bounced from an extended Master Cycle low on Friday. The low may be confirmed with the crossing of the 50-day Moving Average at 98.09, offering a potential buy signal. Dollar bears rejoiced at the Powell speech, anticipating lower yields and a lower USD. However, the USD has already broken out of its downtrend and may cause a fresh batch of short covering.

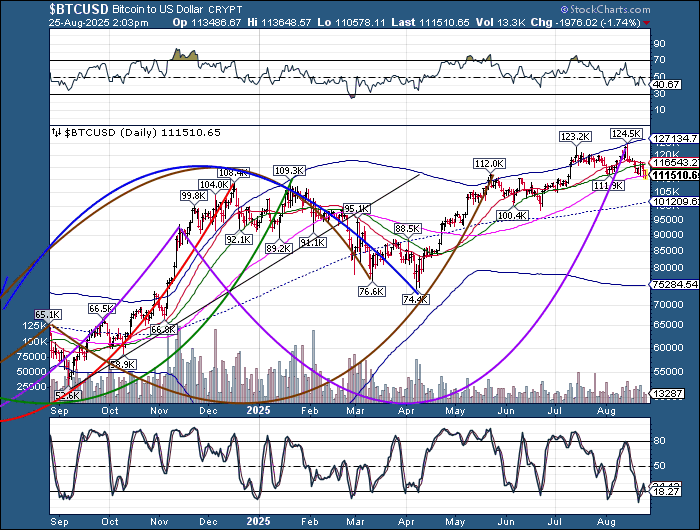

Bitcoin futures reversed down from the 50-day Moving Average at 116543.00 on Friday and is now testing the 100-day Moving Average at 115575.00. It is on a confirmed sell signal. The Cycles Model suggests another week of decline before a bounce to retest overhead resistance.