The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:00 am

Good Morning!

SPX futures consolidated beneath the trendline after bouncing off Intermediate support. The bounce may develop further, with a potential target at the 61.8% retracement at 6428.00, or to the trendline, now approaching 6450.00. A new, all-time high is possible, due to the structure of the fractal. However, it may not last. The Cycles Model allows one last blast of trending strength today before the downtrend may take hold. The buyback blackout begins after Labor Day. Critical support lies at 6338.00.

Today’s options chain shows Max Pain at 6400.00. Long gamma may begin above 6430.00 while short gamma resides beneath 6350.00.

ZeroHedge reports, “US equity futures dropped, extending the recent selloff into its fifth day, as traders stayed guarded ahead of the Federal Reserve’s gathering at Jackson Hole. As of 8:00am, S&P 500 futures fell 0.2%, while Nasdaq 100 futures were flat after a two-day selloff that erased 2% off the index. In premarket trading, Nvidia rose 0.8% while most Magnificent Seven peers posted losses. Retail giant Walmart brought Q2 earnings season to an unofficial close after reporting an EPS miss (68c vs exp. 74c) and even though it lifted guidance (now expects net sales to rise 3.75% to 4.75% this year, versus previous forecast of a 3% to 4%) that wasn’t enough for the market, however, and the stock dropped in premarket trading. European stocks dropped 0.3%, erasing an earlier gain, and snapping a three-day winning streak. US treasuries fell, pushing the yield on the 10-year higher to 4.31%. The dollar strengthened and reversed all of yesterday’s losses while Brent crude rose to the highest in two weeks even as the rest of the commodity complex was mixed. It’s a busy economic calendar: we get weekly jobless claims and August Philadelphia Fed business outlook (8:30am), S&P Global US PMIs (9:45am) and July leading index and existing home sales (10am). The Fed speaker slate includes Atlanta Fed President Bostic at 7:30am, the last central bank official slated to speak before Chair Powell’s discourse at Jackson Hole Friday.”

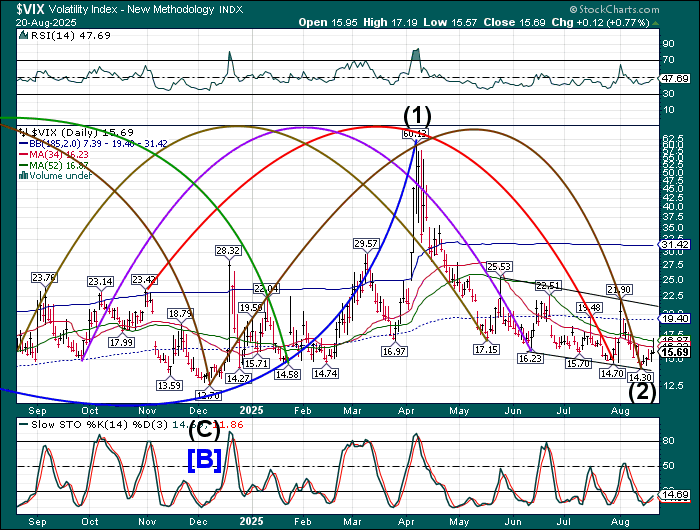

VIX futures ae consolidating inside yesterday’s trading range. VIX has issued a buy signal and the pullback offers the opportunity purchase cheap hedges. The Cycles Model suggests that trending strength may appear next week.

The August 27 options chain shows short gamma at 15.00-16.00. Long gamma begins at 17.00. While sentiment is swinging long, there is not a lot of conviction, yet.

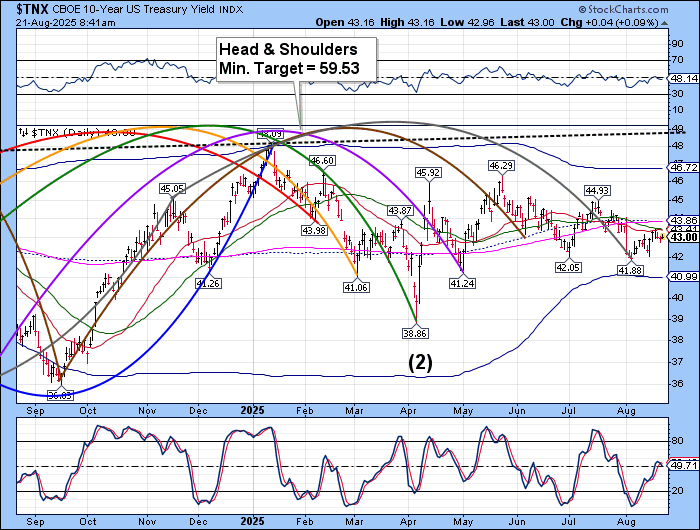

TNX is easing down, in anticipation of a Powell rate cut in September. The 10:00 am speech tomorrow may be used to announce upcoming policy changes. Money markets are pricing in an 80% chance of a .25% rate cut in September. Should the speech be nuanced in favor of a rate cut, we may see TNX pay a visit to the Cycle Bottom at 40.99.

ZeroHedge reports, “With bond yields sliding thanks to the ongoing stock drawdown, there wasn’t many concerns about demand for today’s 20Y auction. And rightly so, because the sale of $16 billion in 20 year bonds went through without any difficulty amid solid, if hardly stellar, demand.

The auction prices at a high yield of 4.876%, down from 4.935% in July and stopped through the When Issued 4.877% by 0.1bps, the second consecutive stop through after 2 tails.”

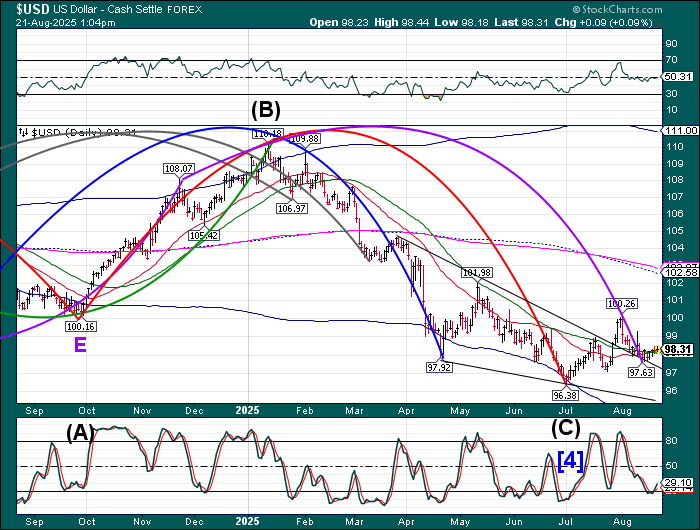

USD futures are rising above the 50-day Moving Average at 98.10, giving a buy signal. Dollar shorts are in for more pain as the rally gains momentum.

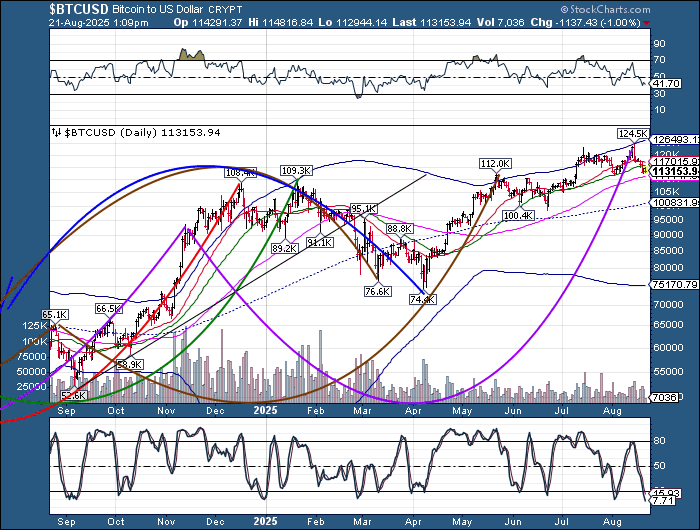

Bitcoin has slipped beneath the 50-day Moving Average at 115,763.45, reinforcing the sell signal. The 100-day is not far away, at 111,147.00. Keep in mind that Bitcoin is a pure speculative play, with no intrinsic value beneath it.