The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

12.45 pm

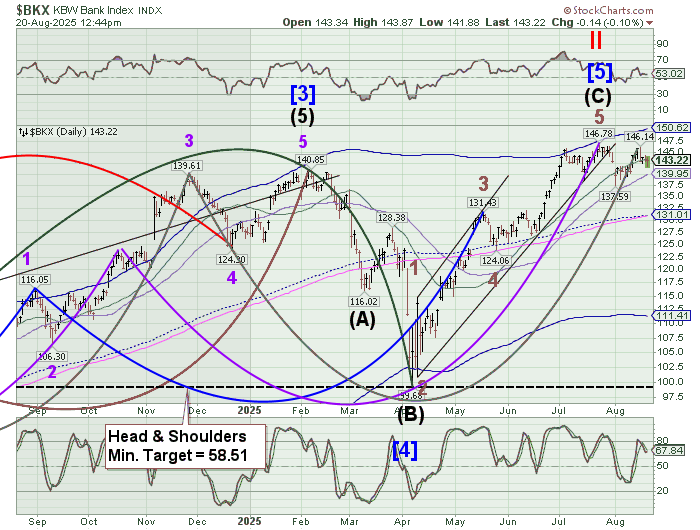

The Banking Index has lost support at the Intermediate level, giving a sell signal. It has pulled back to test Intermediate resistance at 143.26. Further erossion beneath the 50-day Moving Average at 139.95 adds confirmation to the sell signal.

12:40 pm

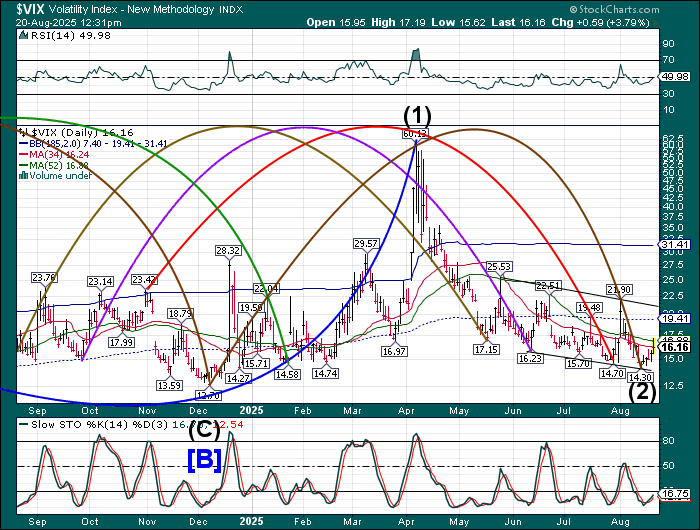

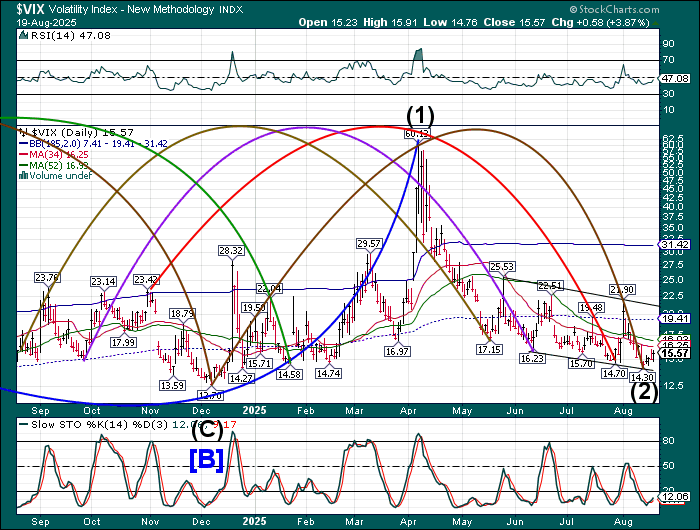

VIX has challenged the 50-day Moving Average at 16.88, offering a buy signal. It’s time to buy the pullbacks.

12:33 pm

SPX has bounced from the Intermediate support at 6341.93 this morning. Crossing beneath the trendline has created a sell signal, allowing investors to short the bounces. The trendline may now act as resistance. The next probable bounce may be the 50-day Moving Average at 6250.90. Some trading desks are telling their customers to buy the dip. The youngsters working there haven’t seen a real sell-off.

8:00 am

Good Morning!

SPX futures declined to 6390.30 this morning, as it flexes beneath the Ending Diagonal trendline near 6420.00. The trendline may be broken. Further confirmation lies beneath Intermediate support at 6333.27 while the 50-day Moving Average gives final support at 6235.60. The Cycles Model suggests the uptrend may be finished by the end of the week, evidenced by the loss of key supports.

Today’s options chain shows Max Pain at 6425.00. Long gamma may begin at 6440.00 while short gamma lies beneath 6400.00. Short gamma may intensify beneath 6375.00.

ZeroHedge reports, “US equity futures are down and headed for a 4th day of losses, but trade well off session lows as markets assess if the sharp momentum selloff we have discussed for the past week will extend into today’s session: the JPM Momentum Basket (JPMPURE Index) is down more than 7% since the CPI print while Goldman said it’s time to resume buying momentum factor. As of 8:00am S&P futures are down 0.2%, after dipping 0.5% earlier in the session; Nasdaq futures are also down 0.2% after the index logged its second-biggest decline since April on Tuesday, with Mag7 names lower premarket ex-NVDA/MSFT; Defensives are outperforming Cyclicals. According to JPM “today feels like a test for the dip-buyers, as Flash PMIs tomorrow and Powell at Jackson Hole on Friday may prove to be market movers/narrative changers.” The yield curve is twisting flatter with the USD not flat. Commodities are seeing a bid across all 3 complexes highlighted by WTI. The macro data today is mortgage applications and Fed Minutes with tomorrow delivering Flash PMIs, jobless data, leading index, and existing home sales.”

VIX futures rose to 16.13 thus far, testing Intermediate resistance at 16.23 after having made its Master Cycle low on August 13. The 50-day Moving Average provides further resistance at 16.99. While technicians may recognize either of these levels as critical, most investors are likely to wait for the breakout above 21.90 to begin hedging. Last week’s monthly options expiration in equities showed dealers owning a record $10 billion in long gamma. Today’s monthly options expiration in the VIX is likely to release a massive short gamma dealer position, allowing the VIX to rise from the “floor” where it has been suppressed for the last several months. The Cycles Model suggests a rally in the VIX to early October.

The August 27 options chain shows virtually no short gamma. Long gamma may arise at 15.00 and extends to 25.00. Conviction in long gamma appears modest.

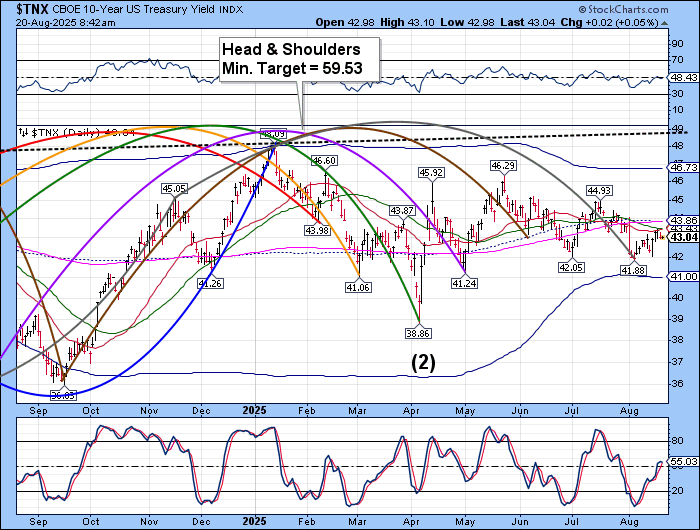

TNX is pulling back this morning from a test of the 50-day Moving Average at 43.43. The Cycles Model allows for an extension of the Master Cycle in time and space. This week may prove the limit in time, while the Cycle Bottom support at 41.00 may give the final target. Jackson Hole may provide some solace for those seeking further rate cuts, but it may not last.

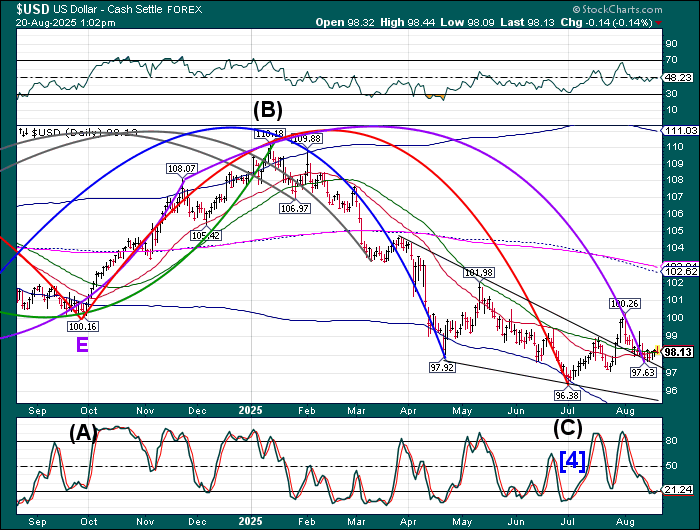

USD futures are hovering near the 50-day Moving Average at 98.12 this morning after a potential breakout. The Cycles Model suggests the USD may resume its uptrend through mid-September. While the Cycles Model offers no immediate insight, there are always outside catalysts that may bring about a reaction.