The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

7:45 am

Good Morning!

SPX futures made a new all-time high at 6488.50 this morning. It is on time to meet or (temporarily) exceed the Cycle Top , currently at 6501.10. The market has narrowed considerably, while growing exponentially. Only two stocks, NVDA and MSFT make up over 15% the the valuation of the SPX. The Cycles Model suggests today is a high strength, high volatility day. It may be a perfect setup for a reversal. Should that be the case, we may see a full-on decline to the end of September.

Today’s options chain shows Max Pain at 6455.00. Long gamma becomes strong above 6490.00 while short gamma dominates beneath 6440.00.

ZeroHedge reports, “The global market rally stalled and US equity futures are flat with small caps underperforming (SPX and NDX made new ATHs yesterday while the Russell still sits ~5% below its ATH) into this morning’s PPI print, where the market may confirm CPI’s trend as well as solidifying PCE estimates. As of 8:00am, S&P 500 futures were flat changed after the benchmark notched a record close for a second straight session; Nasdaq futures dropped 0.2% after Cisco shares fell after issuing a cautious full-year revenue outlook. Europe’s Stoxx 600 rose 0.3%. Pre-mkt, Mag7 names are mostly higher with Semis weaker; Defensives looking stronger than Cyclicals with healthcare leading. Bond yields are lower as the curve bull flattens: the yield on 10-year notes dropping two basis points to 4.21%. Bitcoin retreated 1.7% from an all-time high and the USD is flat. Today’s macro data focus is on PPI and Initial Jobless Claims; an in-line print in both should support stocks. JPMorgan says that should the rally resume, look for RTY to close the gap to tech/large caps.”

VIX futures are consolidating in a narrow range just above yesterday’s low. Today is day 251 of the current Master Cycle. The Cycles Model suggests it may be a high volatility day. ‘

The August 20 (monthly) options chain shows short gamma strong between 16.00 and 18.00. Long gamma is strong above 20.00. Large institutional positions are filling in above that.

10-year Treasury yield futures show a decline to 42.01 this morning. The likelihood that TNX may reach the Cycle Bottom at 41.01 this week is high. The yield drift lower may be about to end dramatically as a high volatility reversal may be due this weekend. Things don’t look good for President Trump’s meeting with Putin.

USD futures may have reversed out of a possible Master Cycle low at 97.47 this morning. Overhead resistance is at 98.05-98.17, above which is a buy signal.

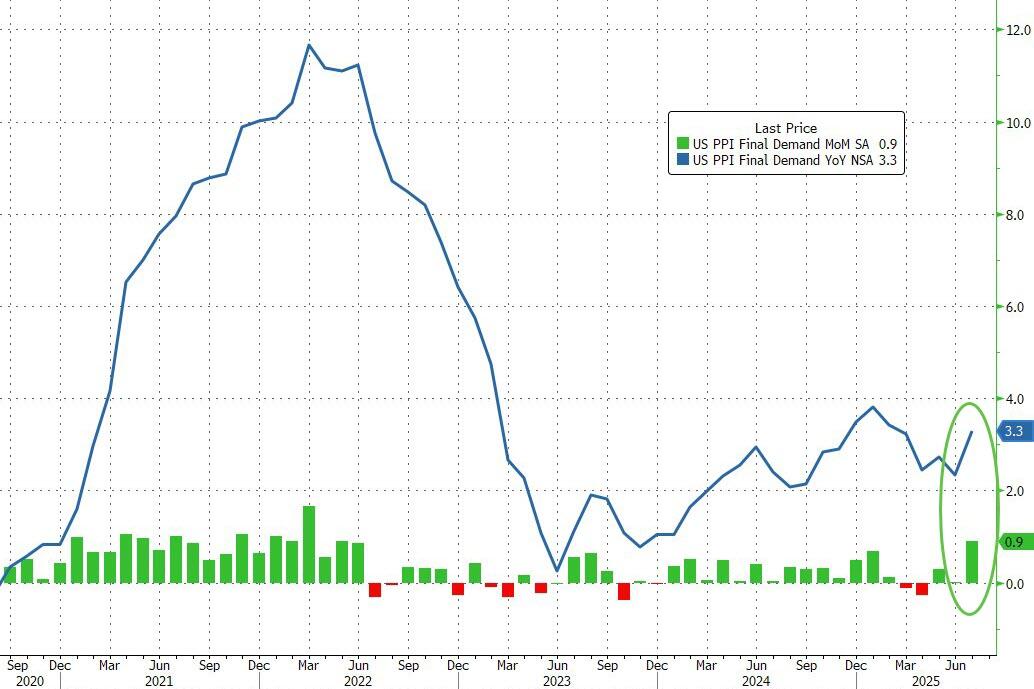

ZeroHedge observes, “Following the ‘mixed’ message from CPI earlier in the week (which the market perceived as dovishly cooler than expected), Producer Price Inflation was expected to accelerate in July’s data released today.

…and accelerate it did – dramatically with headline PPI rising 0.9% MoM (massively more than the +0.2% expected and the biggest jump since June 2022) sending PPI up 3.3% YoY (highest since Feb 2025)..”

”