The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:15 am

Good Morning!

SPX futures consolidated beneath yesterday’s retracement high at 6407.25, leaving a complex fractal formation. Regardless of the reactions to the CPI print this morning, SPX is poised for an imminent, sharp decline by the end of this week. The uptrend may be broken and the support at the 50-day Moving Average may be tested or broken, as well. After a 5-day ride on the escalator, the elevator may be engaged for the trip down.

Today’s options chain shows Max Pain at 6390.00. Long gamma resides above 6400.00 while short gamma becomes strong beneath 6350.00. Conviction is not strong in either direction. However the 0DTE traders may pick up on any directional swing.

ZeroHedge reports, “US equity futures are flat into today’s CPI print, which is expects to show a modest increase in YoY prints (full preview here) with bond yields reversing an earlier drop. As of 8:00am ET, S&P and Nasdaq futures were down 0.1%, with Mag7 names mixed in premarket trading: NVDA is lower as China asks firms to not use the H20 chips; Intel gains after its CEO met Trump last night with Trump posting positive comments after the meeting. European stocks erase early gains of as much as 0.4%. The dollar gains for the second day while US Treasuries trade flat, with the yield on 10-year notes at 4.29%. Commodities are higher led by Metals; gold is flat at $3350 as is bitcoin which trades just under $119K. Trump announced he would nominate labor stats critic EJ Antoni for head of BLS. US economic data slate focuses on the CPI print at 8:30am; we also get the July federal budget balance at 2pm.”

8:30 am

VIX futures made a new low (15.21 thus far) at the announcement of the CPI this morning.

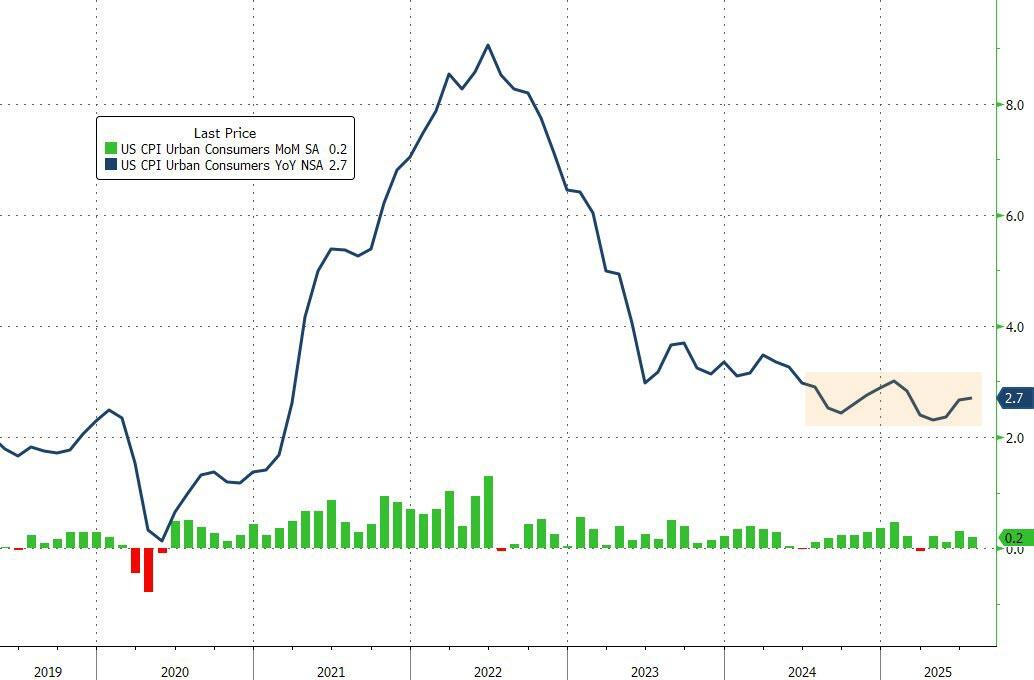

ZeroHedge observes, “With a new boss looming at The BLS, one wonders what the ‘old boss’ has in hand for today’s CPI data (with consensus seeing both headline and core YoY price changes ticking higher) after June’s consumer prices came in cooler than expected, disappointing the Trump Tariff Tantrum crowd. Will this time be different… Will the dreaded tariff-flation show up this time?

Headline CPI rose 0.2% MoM in July (as expected) and +2.7% YoY (cooler than the 2.8% expected) and in line with the June print…”

TNX is heading lower this morning. The probability of reaching the Cycle Bottom at 41.05 in the next couple of days is very high, extending the Master Cycle low.

ZeroHedge comments, “Central banks have become the dominating force in financial markets.

Easing and tightening decisions move all assets from bonds to private equity. Their role is supposed to be to control inflation, provide price stability, and ensure normal market functions. However, there is little evidence of any success in achieving their goals. The era of central bank dominance has been characterised by boom-and-bust cycles, financial crises, policy incentives to increase government spending and debt, and persistent inflation. Recently developed economies’ central banks have taken an increasingly interventionist role.”

USD futures have declined beneath the 50-day Moving Average at 98.22, extending the Master Cycle a few more days. Thus far it has bounced off Intermediate support at 98.02. However, it may yet decline to the 97.00 area by the end of the week.

Gold futures may have declined beneath the 50-day Moving Average at 3347.33 this morning. This may confirm the sell signal in gold. The Cycles Model suggests a decline may last through early September.