The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

3:26 pm

SPX has been challenging Sort-term support at 6314.00 this afternoon. While t is possible that support may hold yet today, the Cycles Model suggests the decline may imminently reassert itself leading to a series of waterfall declines starting next week. Best to be prepared sooner than later.

8:10 am

Good Morning!

SPX futures have risen to an overnight high at 6401.80. The former “buy the dip” investors are now buying the top, as they have lost all fear of the elevated risk. The NYSE Hi-Lo index closed at -24.00 yesterday, setting off warning bells for those that are aware that decliners have now outpaced advancers. There is serious liquidation under the surface, while the number of advancers become smaller and smaller. The SPX is trading above support at 6300.00. Should that level break, the sell signal changes from aggressive to confirmed. Further confirmation lies beneath Intermediate support at 6247.00 while the 50-day Moving Average waits at 6146.00.

Today’s options chain shows Max Pain at 6340.00. Long gamma strengthens above 6370.00 while short gamma prevails beneath 6300.00.

ZeroHedge reports, “US equity futures are – what else – higher, and rapidly approaching a new all time high, boosted by exemptions in Trump’s plans for 100% tariffs on chips that are seen as bullish ways for most big tech firms to avoid levies. The mood was also cheered by a report that Trump and Putin are expected to meet for summit talks in the next few days while

hopes for a rate cut rise some more as additional Fed officials have dovish pivots. As of 8:15am ET, S&P futures are up 0.6% and Nasdaq 100 futures gain 0.7% with Mag7 higher led by AAPL while Semis are the global standout. Eli Lilly & shares plunged after the drugmaker reported underwhelming study results for its weight-loss pill. Shares of its main European rival, Novo Nordisk A/S, soared. Cyclicals are poised to rip, although as JPM notes “today appears to be setting up for an ‘Everything Rally’.” Bond yields are down 1bp across the curve but 10Y is +1bp; USD is flat but has erased ~25bp of overnight losses. Today’s macro data focus is on Jobless Claims, 1Y Inflation Expectations, Nonfarm Productivity, Labor Costs, Consumer Credit, and Inventories. While none, ex-Claims, are market moving it will help sharpen the macro picture on the labor market and consumer. At 12pm, Trump will sign an executive order that aims to allow private equity, real estate, cryptocurrency and other alternative assets in 401(k)s.”

VIX futures declined to 15.98, giving a nod to the short gamma crowd at options expiration. Note that a buy signal has been issued, offering a chance at highly discounted hedge. However, the offer is being ignored by the crowd, who believe they are invincible. The Cycles Model suggests we may see the VIX resume its ascent by the weekend, with trending strength becoming evident next week.

The VIX August 13 options chain shows short gamma at 15.00-16.00. Long gamma may begin above 17.00, but shows a singular lack of conviction as all eyes are on the bounce.

The 10-year Treasury Yield is consolidating this morning above its provisional Master Cycle low on Tuesday. There is an outside chance that TNX may yet probe lower in the next few days. The Cycles Model suggests that there may be a strong reversal day early next week, so we wait patiently for a signal that the uptrend is resuming.

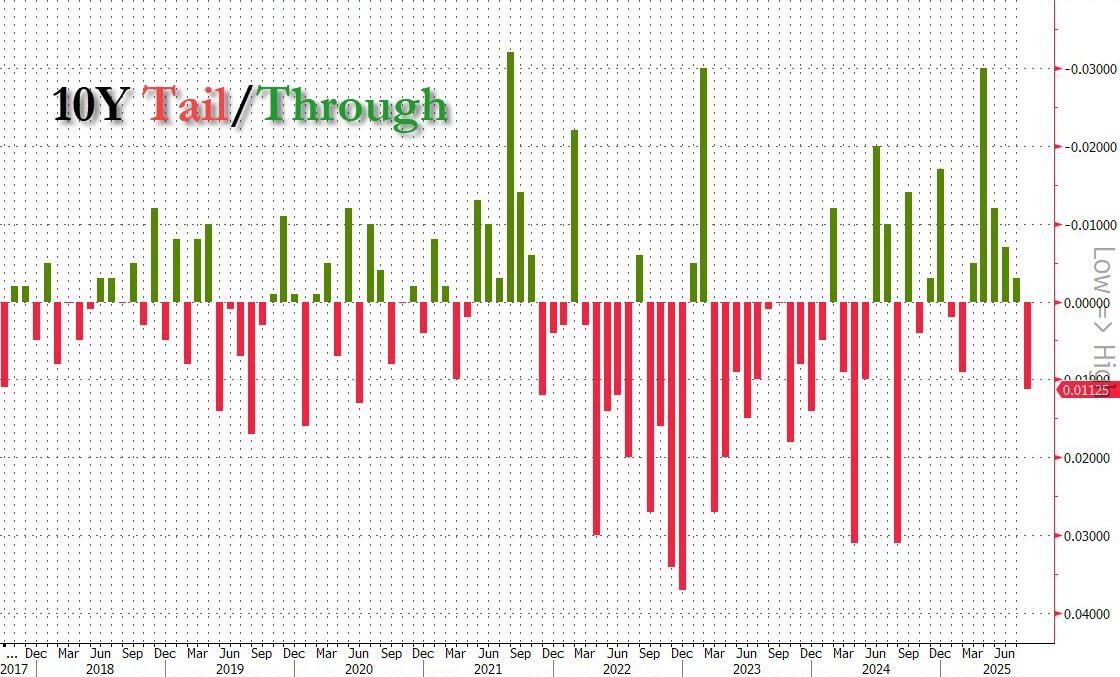

ZeroHedge reports, “After yesterday’s dismal 3Y auction, markets were on edge ahead of today’s $42 billion reopening of the 10Y benchmark auction. And they had a good reason to be: the just concluded 10Y auction was not pretty.

Starting at the top, the auction stopped at a high yield of 4.255%, down from 4.362% in July, and the lowest since December. So far so good, however, the yield also tailed the 4.2440% When Issued by 1.1bps, the first tail since February, and follows 6 stop throughs.”

USD futures made a morning low at 97.75, possibly fulfilling its Master Cycle low. Should that be so, a reversal may be imminent. Once the correction is complete, the USD may resume its uptrend with strength by mid-week.