The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:45 am

Good Morning!

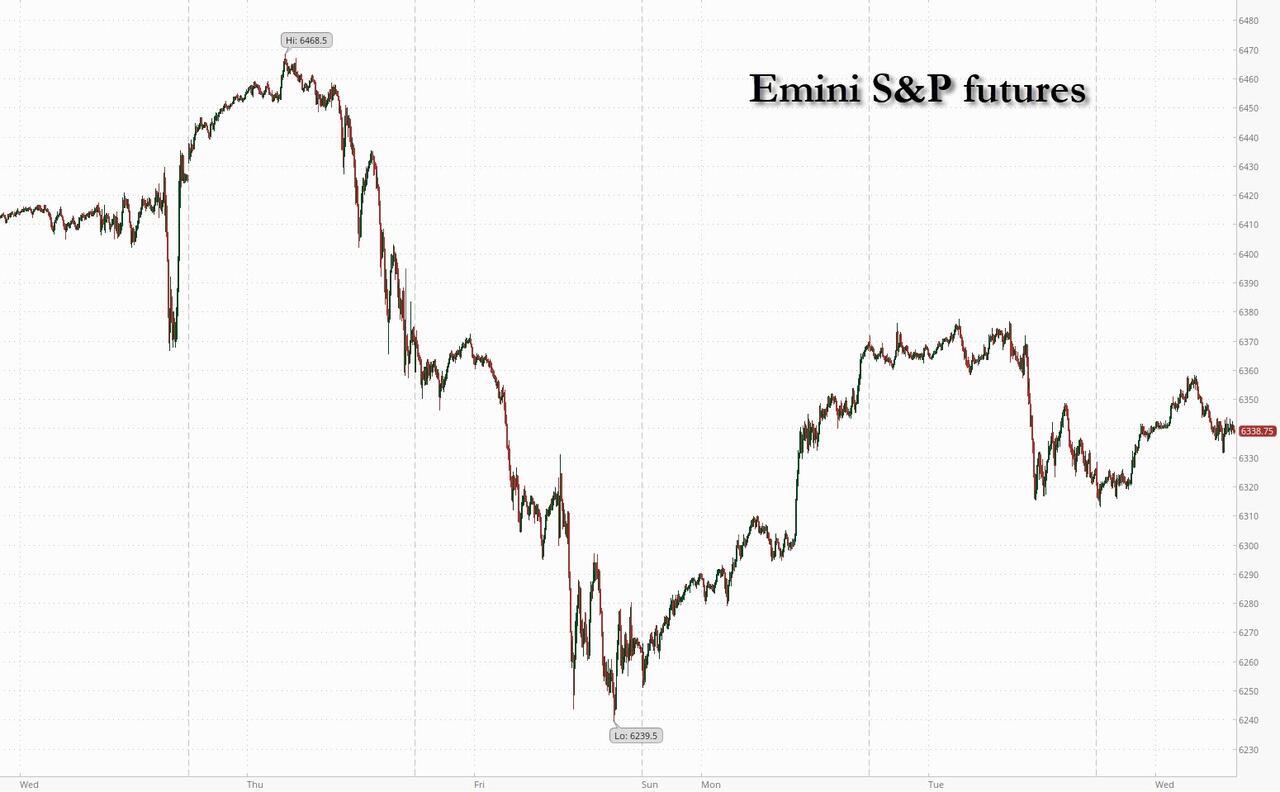

SPX futures rose to 6332.90 this morning, but eased lower for the open. The fear of missing out on the next big surge is trapping more investors as serious money may be leaving. The anticipation of future rate cuts may be foolhardy in the face of systematic de-risking by commercials and hedge funds. A further decline beneath Intermediate support at 6246.43 may give pause to the dip buyers, while a decline beneath the 50-day Moving Average at 6146.75 may open the floodgates with more selling. The Cycles Model calls for further deterioration until the weekend, when trending downside strength may appear. Should that occur, it may introduce a series of waterfall declines over the following week.

Today’s options chain shows Max Pain at 6315.00. Long gamma resides above 6330.00 while short gamma becomes strong beneath 6300.00.

ZeroHedge reports, “US futures rebound from yesterday’s modest drop as the market shakes off stagflationary concerns raised by NFP/ISM, although spoos trade well off their early session gains. As of 8:00am ET, S&P 500 futures and Nasdaq 100 futures were 0.2% higher. In premarket trading, McDonald’s and Shopify jumped after earnings beats; Mag7 names are mostly higher while Semis are dragged with downbeat AMD/SMCI earnings (see below). DIS/UBER highlight pre-mkt earnings releases; the former is lower on disappointing TV revenues, while the latter is flat despite solid results. Energy, Industrials, Healthcare and Utilities are stronger, too. Yields are bear steepening and the USD is flat for the second day. The Swiss President arrived in DC yesterday to meet with Trump, even as the US president preps new sanctions against Russia’s shadow tanker fleet unless Putin agrees to a cease-fire by Friday; WTI did not react to this news. Witkoff to meet with Russian officials today. Macro data releases are light with only mortgage apps but keep an eye on 10Y bond auction today at 1pm. EPS still a top priority for investors with another slew today.”

VIX futures have declined to 17.15 this morning in a nod to the put buyers. Today is options expiration may release the hold that short gamma may have on the VIX. 0DTE speculators are piling on to the latest move, increasing the volatility until it breaks. A bounce above the 50-day Moving Average at 17.61 may reinforce the buy signal. Today’s pullback offers the next best hedging opportunity.

The August 13 options chain shows short gamma occupying the space between 15.00 and 17.00. Long gamma takes over at 18.00, but there is little conviction on the long side.

TNX is hovering above its (possible) Master Cycle low at 41.98. While TNX has fulfilled its time requirement for the Master Cycle, price may be questionable. The fractal may need a final probe to the Cycle Bottom at 41.08 to be complete. Should it be so, the fractal may be complete by the weekend.

ZeroHedge comments, “One week after the Treasury’s refunding announcement unveiled no major changes to the coupon auction schedule for the next few months, instead punting everything to Bills and leading to the following headline this morning:

- *US TREASURY TO AUCTION $100 BILLION IN FOUR-WEEK BILLS

… moments ago we got the first actual refunding auction of the week when the Treasury sold $58BN in 3Y paper in a very mediocre auction.”

USD futures declined to 98.16 this morning as it probes toward Intermediate support at 98.00. It is likely that the USD may reach its target, completing the current Master Cycle, by the weekend.

The Ag Index has reached its lowest point since April 2024. With it, the Master Cycle may be complete. The Cycles Model calls for a short but sharp rally out of the low. We may anticipate a rally to the 50-day Moving Average at 366.58 by month end.

ZeroHedge remarks, “Farmland is one of the oldest asset classes, rivaling precious metals in its ability to preserve generational wealth.

Unlike stocks or fiat currencies, farmland and cropland are tangible, finite, and highly productive. As the global population continues to grow and demand for healthier food intensifies, arable land per capita is shrinking due to urban sprawl and environmental degradation. This makes farmland not just a low-volatility store of value, but also a necessary hedge against rising global instability and inflationary pressures.”

ZeroHedge further reveals, “Ground beef prices are at record highs, while the U.S. cattle and calf herd has fallen to its lowest level in 50 years. Understanding these dynamics, we’ve been carefully watching for a cyclical low in the 12-year herd cycle, a bottom that now appears to have been reached.

New comments from Tyson Foods CEO Donnie King during Monday’s earnings call point to a long-awaited herd rebuilding cycle set to begin “in earnest” next year, though any meaningful supply recovery likely won’t materialize until 2028.”