The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

10:44 am

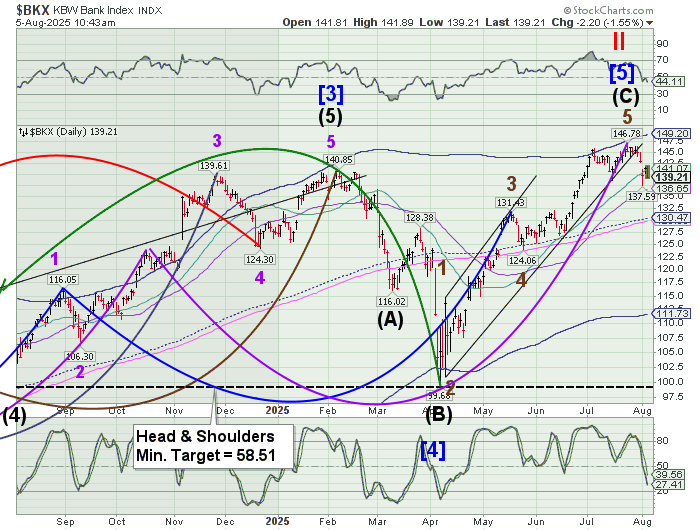

BKX challenged its Intermediate resistance at 141.07 yesterday, then slipped beneath it this morning, reiterating its sell signal. There may be a week left in the current Master Cycle, allowing BKX to test the 50-day Moving Average at 136.65.

8:25 am

Good Morning!

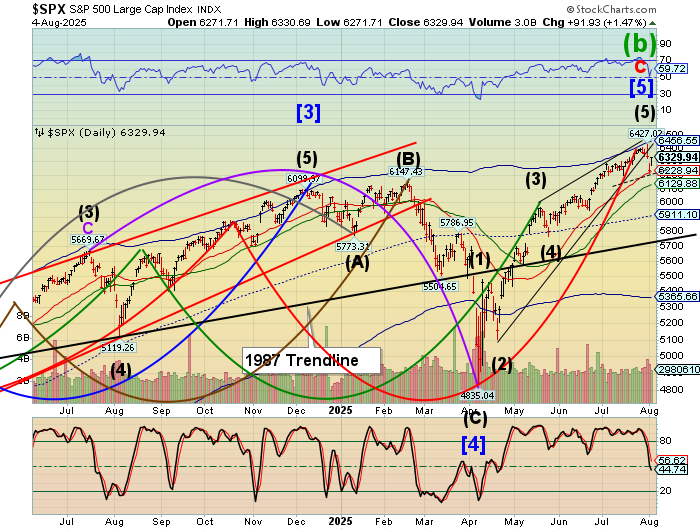

SPX futures rose to 6350.09, slightly above the 61,8% Fibonacci retracement value at 6344.37. It is likely that the SPX daily session may open above yesterday’s close. However, the fractal pattern suggests a turn down shortly after the open. A decline beneath Friday’s low at 6212.69 may bring about a potential waterfall decline to 6000.00. Recognition of a break in the trend occurs at the 50-day Moving Average currently at 6129.88. Until then, buying the dip may be encouraged.

Today’s options chain shows Max Pain at 6320.00. Long gamma gets a big boost at 6350.00, while short gamma goes large beneath 6300.00.

ZeroHedge reports, “Risk is mostly higher again this morning, last Friday’s selloff long forgotten, with equity futures and macro credit opening stronger while the yield curve is bear flattening as rates sell off across the curve, and the USD is higher. As of 8:00am ET, S&P futures are up 0.3%, led by small caps, pointing to further squeeze potential from shorts put on as recently as Friday; Nasdaq futures gained 0.4% as Palantir’s blowout earnings beat and commentary added more fuel to the AI trade. Pre-market, semis are standing out with Mag7 names higher; Industrials are leading Cyclicals over Defensives. Staples are in the red as the market continues to buy most dips/anything AI related along with squeezing shorts (GS Most Short Rolling +3.9% yday). Trade tensions ratchet higher as geopolitics enter the debate. According to Goldman, along with rising rate-cut bets, there are enough positive drivers to outweigh lingering concerns about tariffs, with India becoming the latest target in Trump’s trade war. Overnight, Fed non-voter Daly said that she would “lean to thinking that every meeting going forward is a live meeting” given the softness in the labor market and no signs of persistent tariff-driven inflation. On the trade front, Swiss President Keller-Sutter and other Swiss officials, in addition to Japan’s trade chief, will travel to the US for separate trade talks. Looking ahead today, the President will speak on CNBC “Squawk Box” at 8am ET. Data wise, we have trade balance, and ISM services. We got better S&P Global Services PMIs out of China (52.6 vs cons 50.4) and Japan (53.6 vs cons 53.5) while Europe was more mixed as UK, Germany, Spain beat but France and Italy missed. There are no scheduled Fed speakers.”

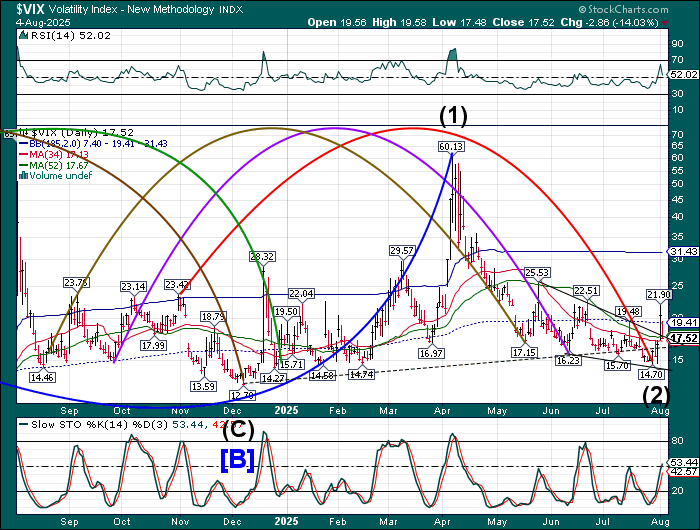

VIX futures are testing Intermediate support at 17.13 this morning. A rise above the 50-day Moving Average at 17.67 reinforces the buy signal. VIX is forming a fractal that may take it to the Cycle Top at 31.43 in short order. Should it do so by the end of the week, the Cycles Model suggests a possible explosion of volatility in the following week.

Tomorrow’s options chain shows massive short gamma between 15.00 and 17.00. Long gamma begins at 18.00 and extends to 30.00, without a lot of conviction.

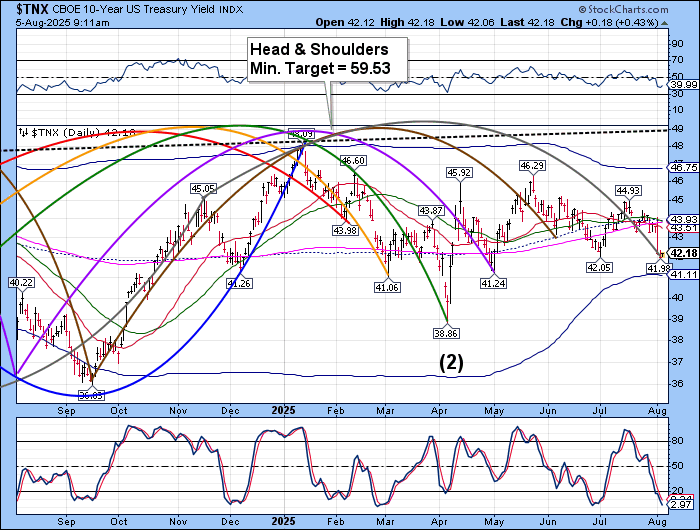

TNX may be emerging from its master Cycle low on Monday, on day 262. The alternate view may be a quick dip lower before reversing. Time is running out on the old Master Cycle, but the Cycle Bottom at 41.11 may still hold some attraction. Once the rates begin to rise in earnest, we may see the Head & Shoulders formation influence rates over the next three months. The rise in the 10-year Treasury rate may be an influence in the housing market. See below.

ZeroHedge remarks, “Lance Lambert, co-founder and editor of ResiClub, posted on X, highlighting an ongoing and record-breaking trend in the housing market: sellers now outnumber buyers by the widest margin since Redfin data began well over a decade ago. The growing number of sellers is especially evident in the U.S. Southwest and U.S. Southeast, particularly in Texas and Florida, where the balance of power has shifted in favor of buyers. ”

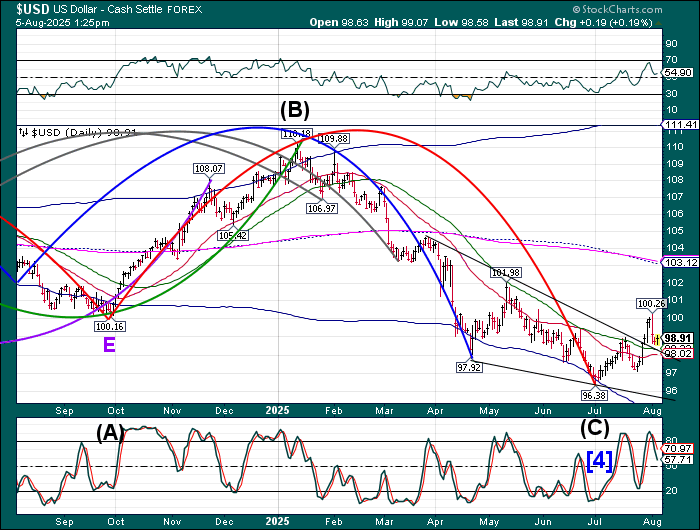

USD futures hit a low of 98.38 in the overnight session, testing the 50-day Moving Average at 98.33. It may go lower, as the Intermediate support lies at 98.02. USD may be in a correction mode until the end of the week. Once completed, the uptrend may resume in strength.

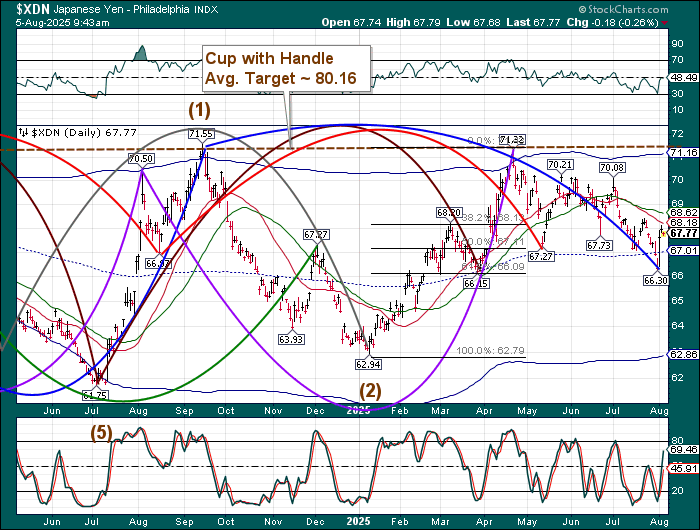

The Japanese Yen emerged from its Master Cycle low with strength on Friday, giving pause to those who are involved in the carry trade. The 50-day Moving Average lies at 68.62. The Cycles Model suggests that another surge may be imminent which may set off alarms in the carry trade, as currency fluctuations may more than offset the low interest rates charged by the Bank of Japan.

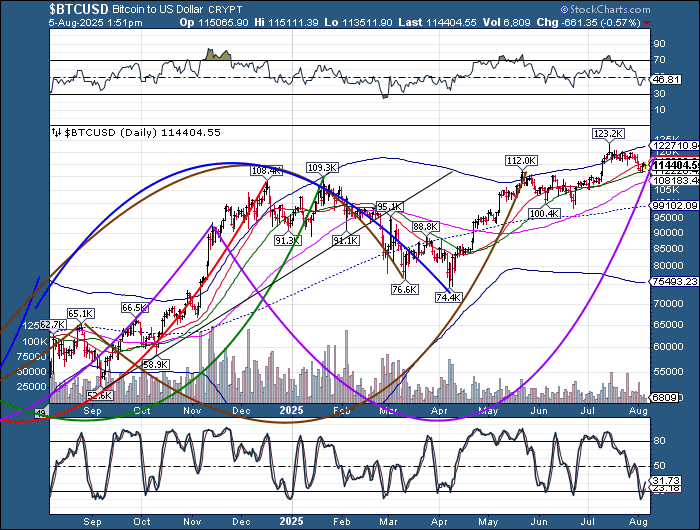

Bitcoin has found support at the 50-day Moving Average at 112221.00 and may be capable of making a new all-time high, according to the Cycles Model. There is a possible open window lasting another week to do so.

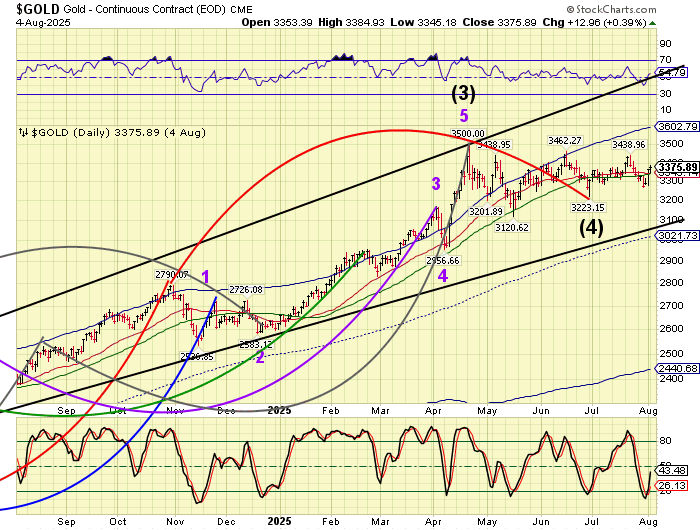

Gold futures are threatening a potential breakout above its previous high, having reached a high at 3437.40 this morning. The Cycles Model suggests another week of potential rally to the Cycle Top resistance at 3602.79.