The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

8:33 am

Good Morning!

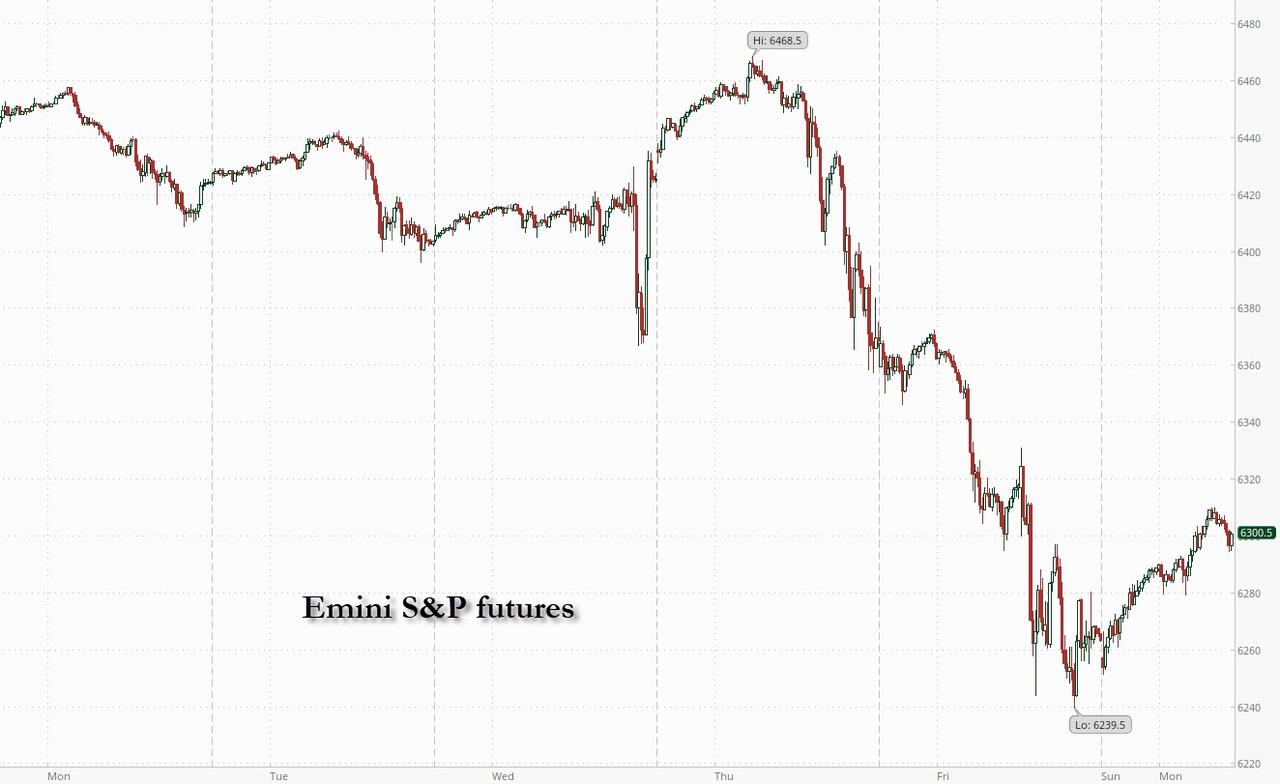

SPX peaked on Thursday and made an immediate sell signal by crossing beneath the Ending Diagonal trendline. Friday’s aftermath was to be expected. This morning’s bounce in the SPX futures has open gap resistance at 6296.79 and may not cross above it for any period of time. The next move may be a further decline to test the 50-day Moving Average at 6122.84, which may hold, at least temporarily. Should it break through the 50-day , the SPX may then decline to round number support near 6000.00. The Cycles Model has given a trending strength indicator that may affect the decline over the next day or two.

Today’s options chain shows Max Pain near 6260.00. Long gamma strengthend near 6290.00 while short gamma rules beneath 6200.00.

ZeroHedge reports, “Futures are higher as markets rebound from last week’s sell-off amid increased expectations the Fed will ride to the rescue with rate cuts following Friday’s dismal US jobs data. As of 7:45am ET, S&P 500 and Nasdaq futures climbed 0.7% after the index had its biggest decline since May on Friday. Pre-market, Mag7 and Semis are outperforming with Cyclicals over Defensives. Bond yields are 2-3bp higher as the USD falls again. Commodities are weaker with Energy underperforming as OPEC+ approves another supply hike. This is a catalyst-light week with tomorrow’s ISM the most important and heightened focus on weekly claims with the Fed spotlighting the unemployment rate.”

VIX futures declined to a low of 18.87 after having crossed above the 50-day, the declining Wedge trendline and the mid-Cycle resistance at 19.44, creating a strong buy signal as volatility reawakens.

The Augus6 options chain shows Max Pain at 18.00. Short gamma still resides between 15.00-17.00. Long gamma may begin at 20.00, but tapers off above 30.00, suggesting little conviction in hedging, yet.

ZeroHedge notes, “After a long period of “complacency” in the market, volatility finally returned on Friday, dropping more than 1%. As we noted Friday morning, before the market opened:

“While stretches have previously been longer, a consideration of such an event is that low volatility tends to beget high volatility. These “buying stampedes” typically last on average about 15 trading days, so at 25 and counting, we are certainly pushing a more extended duration.””

TNX is consolidating near 42.00. This suggests a final probe to the Cycle Bottom at 41.12, completing the Master Cycle in the next few days. A possible bottom on August 11.

After a nearly 5-month consolidation, gold futures have broken out above its most recent high, reaching 3439.32 this morning. The Cycles Model anticipates a week or longer of rally, possibly aiming for the Cycle Top near 3600.00, or much higher, depending on world events. It is on a buy signal.

Crude oil futures challenged the 50-day Moving Average at 66.21, then bounced above it, hovering beneath the mid-Cycle resistance at 67.96. Rising above that level reaffirms the buy signal in place since May. The Cycles Model indicates a continued rise in the price of oil through the first week of September, likely validating the Head & Shoulders formation.

ZeroHedge observes, “President Trump switched his attention from the domestic jobs figures to the price of oil this morning with a Truth Social post that lambasts India for their dealings with Russia:

“India is not only buying massive amounts of Russian Oil, they are then, for much of the Oil purchased, selling it on the Open Market for big profits.”

Then Trump made the threats:

They don’t care how many people in Ukraine are being killed by the Russian War Machine.

Because of this, I will be substantially raising the Tariff paid by India to the USA.

Thank you for your attention to this matter!!! President DJT

And oil prices spiked on the news…”