The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

1:45 pm

SPX has crossed beneath the diagonal trendline near 6380.00 and yesterday’s low at 6375.79, qualifying for a sell signal, although a shallow one. The break of an Ending Diagonal brings the possibility of a complete retracement to the April 7 low. The VIX has also reversed out of its Master Cycle low today, giving further confirmation. Have a good week!

8:00 am

Note: I will be leaving for a week-long sabbatical tomorrow.

Good Morning!

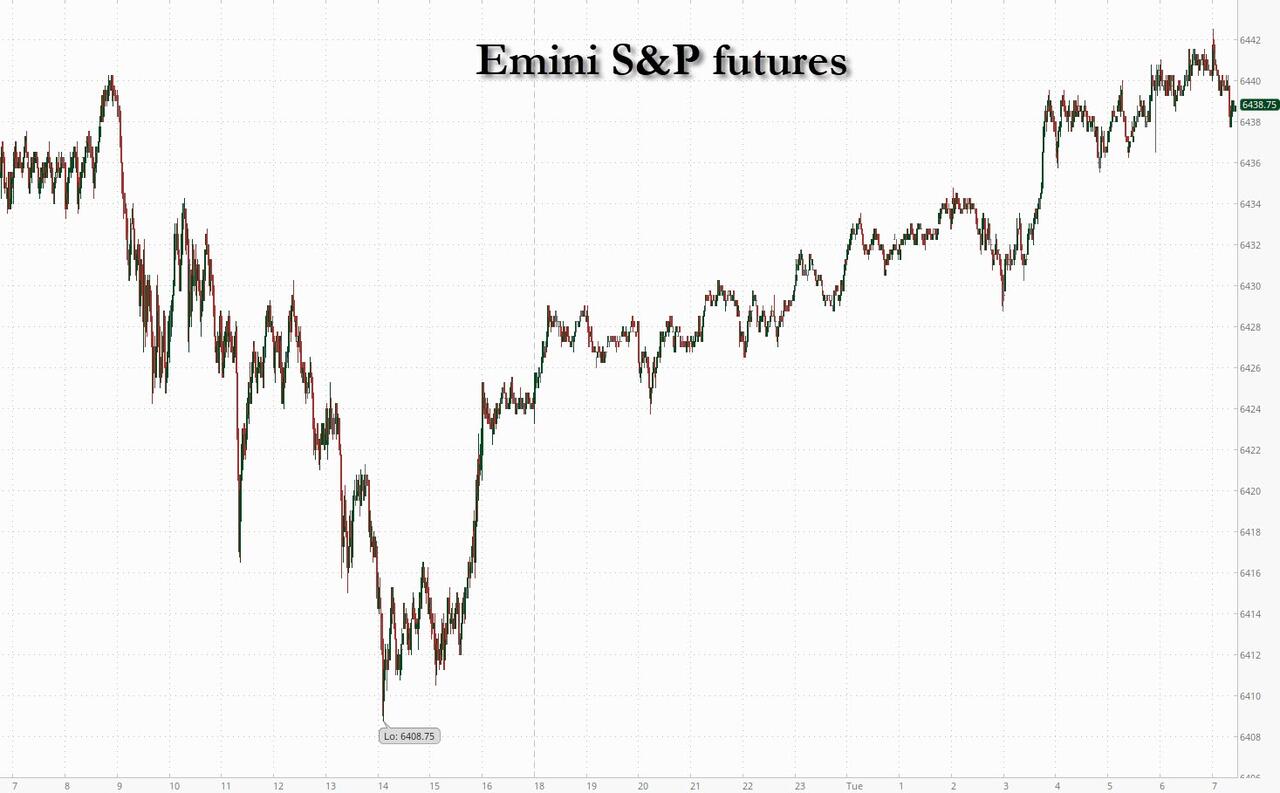

SPX futures are trading in a narrow range between 6391.00 and 6410.00 this morning. Having met round number resistance at 6400.00, investors may attempt to leapfrog over that level. However, fractal resistance is at 6416.00, while the Cycle Top awaits at 6425.00. These are behavioral constructs that suggest new buyers may not be waiting above those levels. In addition, high hopes of the FOMC announcing rate cuts at tomorrow’s press conference may be dashed. The Cycles Model suggests an imminent reversal, perhaps at the FOMC announcement with a possible three-week decline with strength.

Today’s options chain shows Max Pain at 6385.00. Long gamma resides above 6400.00 while short gamma awaits beneath 6350.00.

ZeroHedge reports, “US equity futures are up again, and set for a 7th consecutive record high into a heavy earnings day and ahead of tomorrow’s Fed decision as attention turns from trade deals to company results and economic data to justify nosebleed valuations. As of 8:00am, S&P futures are 0.2% higher after the index hit its latest record high on Monday; tech is outperforming again and Nasdaq 100 contracts up 0.5%. In pre-market trading, Mag7, Semis, and Cyclicals are outperforming. Bond yields are lower (10Y yield at 4.3919%, down 2bps) as the USD rally is poised to continue after the dollar climbed to its strongest level in more than five weeks on speculation a slew of readings on the economy will show the tariff impact is contained. Commodities are mixed with energy leading on US / RU geopolitics. The macro data focus today includes JOLTS, Housing Prices, regional Fed activity indicators, trade data, inventories, and consumer confidence.”

VIX futures have made a new low at 14.70 this morning, clearly showing no concern for risk in equities. Both time and price have been stretched in this Master Cycle. However, the declining wedge warns of a snap-back to the April high.

Tomorrow’s options chain shows heavy negative gamma at 15.00 – 16.00. Long gamma may rebound above 22.00.

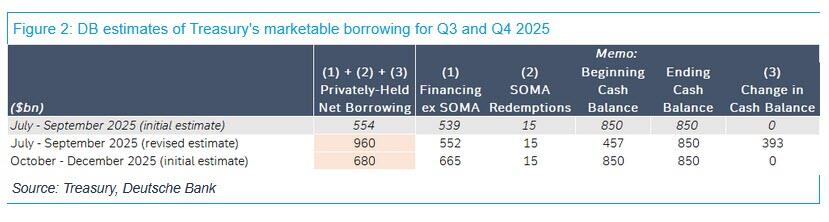

TNX is testing the 200-day Moving Average at 43.75 this morning. The Cycles Model shows there may be serious pressure on the 10-year today. Support may lie at the July 22 low at 43.28. While the Chinese continue to sell treasuries, the Treasury announced a surge in borrowing in the third quarter.

ZeroHedge remarks, “Earlier this afternoon, we wrote in our Treasury refunding preview that the Treasury’s latest borrowing estimate published today (which is also part 1 of the Refunding statement), would show a surge in current quarter funding needs by over $400 billion, from $554 billion to $960 billion.

It was short by almost $50 billion. We found that out moments ago when the Treasury published its estimate for marketable borrowing needs for the July-September 2025 and October-December 2025 quarters. ”

The USD broke above its declining wedge at 98.50, showing a change in trend and a confirmed buy signal above the 50-day Moving Average at 98.38. The Cycles Model shows a very strong surge higher over the next week or more. Dollar shorts are now in the crosshairs, as a probable target may be the mid-Cycle resistance at 103.31.

The Japanese yen may be retesting the mid-Cycle support at 66.97 today. Should that be so, the Master Cycle may be stretched a bit more. However, it may subsequently explode significantly higher as the uptrend reasserts itself. Those in the Yen carry trade who have become comfortable with the past four months of sideways motion find the pain of a rising borrowed currency may become acute.

ZeroHedge observes, “As Trump publicly dressed down Powell during a Fed facility tour, markets watched in disbelief. But behind the cringe-worthy optics lies a deeper crisis: global yields are surging, and Japan—yes, Japan—is the canary in the coal mine. “Watch JGB yields every morning,” warns Peter Boockvar, as the BOJ loses control amid rising inflation and political fallout.”

Bitcoin is in the final throes of its all-time high above 123200.00. With it may come the end of the current Master Cycle, due to make its reversal this week. Keep an eye on the action, as the reversal may be swift and deep. The Cycles Model suggests the month of August may be a complete washout.