The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us8:00from evil. Amen.

8:00 am

Good Morning!

I have been able to recover my charts, but for an unknown duration. Tuesday may be my last day of commentary, as I will be taking a week-long sabbatical on Wednesday.

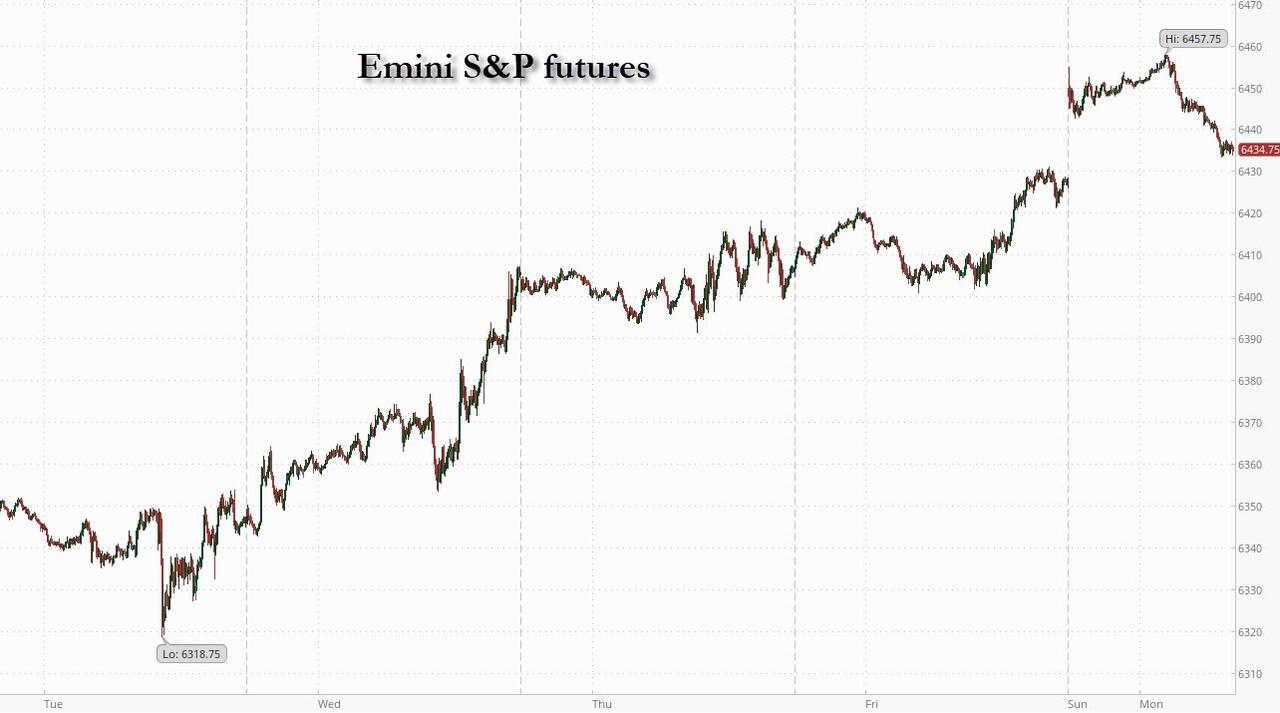

SPX futures rose to 6423.30 over the weekend, but has declined thereafter, testing round number support at 6400.00 as I write. Over the weekend it has tested the Cycle Top resistance at 6417.40. I had previously mentioned a fractal target at 6416.000 last week. Thus the SPX has met fractal equality and the Cycle Top simultaneously. A decline beneath 6400.00 offers an aggressive sell signal while a further decline beneath the diagonal trendline at 6350.00 breaks the uptrend. The 50-day Moving Average at 6080.00is where recognition is made that, should the SPX decline beneath it, a widely recognized sell signal may be found.

Today’s action may produce a new all-time high, followed by a reversal. Otherwise, Friday’s daytime high at 6395.82 may serve as the official all-time high, should the SPX break beneath 6400.00 this morning. The Cycles Model shows a possible drift lower, but may remain steady until the week of August 10. This may encourage speculators to go all-in for a short period of time. The question is, “Who will buy at the all-time-highs?”

Today’s options chain shows Max Pain at 6385.00. Long gamma may prevail above 6390.00 while short gamma resides beneath 6350.00, where the trendline may be crossed.

ZeroHedge reports, “Another day, another all time high.

US equity futures and global markets are at a fresh all time high (but the gains are fading) on a trade-induced, global risk-on rally, sparked by Sunday’s US/EU deal for 15% tariffs on European exports to the US, while we also learned that US/China will extend the trade truce by 90-days as they resume negotiations today. As of 8:00am ET, S&P futures are up 0.2%, well off session highs, while Nasdaq futures gain 0.3%. Pre-market, all Mag7 names are higher with semis outperforming. Cyclicals are poised to outperform, led by Fins/Industrials. Bond yields are up 1bp, reversing an earlier drop, as the USD appreciates on the back of a slide in the euro and yen. Commodities are mixed with crude higher, natgas lower, precious metals flat, base metals down, and Ags mixed. Today’s macro data is light with on Dallas Fed Mfg Activity but it’s a crazy busy week with the Fed decision on deck, 38% of all companies reporting, the jobs report on Friday and much more (full preview coming).”

VIX futures may be coming off their Master Cycle low on Friday at 14.92. Futures have consolidated between 15.11 and 15.29, showing possible strength in the new trend. VIX may consolidate beneath the 50-day Moving Average at 17.84 for the next two weeks. The declining wedge trendline lies at 19.00, above which a new uptrend is begun.

TNX consolidated between 43.67 and 44.31 over the weekend. A show of strength may be imminent which may allow TNX to break above its consolidation. Should that occur, the neckline at 49.00 may be tested. The Cycles Model suggests a continued rally in rates through the end of September.

USD futures are testing the 50-day Moving Average at 98.41 this morning. The Cycles Model suggests this may only be a test and not a breakout. There are approximately 2 weeks left in the current Master Cycle, which may test the lower trendline near 96.00. Should it break above the 50-day a new uptrend may be found. However, the current trend is still down.