The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

10:57 am

BKX, our liquidity proxy, has crossed beneath the upper trendline, offering investors an aggressive sell signal. This signal tells us to lighten our exposure to the Banking Index. Intermediate support lies at 135.30, beneath which is a confirmed sell signal. Banks are on very thin ice. While many smaller banks are consolidating and being purchased by larger ones, there may be some regional banks nearing illiquidity.

10:00

SPX is crossing the support line at 6100.00. This begets an aggressive sell signal. Most should lighten their longs, while only the brave may attempt to go short. This is the end of the Master Cycle and further upside may be minimal, if at all. While short-term support lies at 6061.61, a sell-side confirmation lies at the 50-day Moving Average at 6013.14.

7:45 am

Good Morning!

SPX futures have declined to 6122.80 thus far A decline beneath 6100.00 may offer an aggressive sell signal. Another short-term support may lie at 6060.00, whereas long-term support lies at the 50-day Moving Average at 6008.00. The 16-month trendline may converge with the 50-day near 6000.00, giving a confirmed sell signal. Quick action may be needed to preserve the small gains eked out in the SPX since the beginning of the year. Professional money managers claim to be bullish on stocks, short everything else, but are selling at a furious pace again as retail investors have redoubled their efforts to “buy the dip.” This is a schizophrenic market.

Today’s options chain shows Max Pain at 6125.00. Long gamma prevails above 6145.00 while short gamma is strong beneath 6100.00.

ZeroHedge reports, “US equity futures slide from the latest record high as concerns around trade tariffs and a disappointing outlook from Walmart weighed on sentiment. As of 8:00am ET, contracts on the S&P 500 and the Nasdaq 100 slipped about 0.3% as Mag7 names are mixed with Semis lower. Palantir was among the biggest losers in US premarket trading, on track to extend Wednesday’s 10% slide, after Defense Secretary Pete Hegseth outlined plans to cut military spending by 8% over the coming years. Walmart plunged 8%, the most in a year, after the company’s guidance disappointed Wall Street. Europe’s Stoxx 50 continues its ascent rising 0.6% led by real estate and auto sector. The potential for a pausing of the Fed’s QT hinted in yesterday’s FOMC minutes helped a late-day rally and Trump says a bigger China trade deal is possible but says there is a shot clock for Ukraine to find a deal. Bond yields are down 2-3bps with the USD weaker as the yen continues its recent surge. Commodities are seeing strength in both Ags and Metals; gold set a fresh all-time high above $2950. The macro data focus is on Jobless Claims and the Leading Indicator Index.”

VIX futures topped out this morning at 15.73, still within the recent trading range. The 50-day Moving Average is at 16.40 while the mid-Cycle resistance is at 16.54. Once above those double resistances, the VIX may surprise to the upside. The reason is that the heavy short presence in the options market has been lifted, creating a vacuum above it.

The February 26 options chain shows Max Pain at 16.00, but virtually no short gamma beneath it. Long gamma begins at 20.00, but so far has been hesitant to reach higher as a hedge.

Bitcoin is being squeezed between the trendline at 96400.00 and the 50-day Moving Average at 99011.00. The Cycles Model suggests there may be another three weeks of decline, indicating a possible breakdown may occur imminently. Should that be the case, the next move may target the mid-Cycle support at 82507.21. Depending on how quickly that may be reached, there may be a considerable risk of reaching the next possible support at 70000.00.

Eurostoxx 50 made its Master Cycle high on February 18 at 5550.00 and has reversed since then. Those who fear missing out on the searing rally may already be too late. This has been a panic rally into stocks because the governments in Europe are in the state of collapse.

TNX may be challenging the 50-day Moving Average at 45.20 this morning. The odds are better than even that TNX may resume its move higher. Confirmation comes above the Intermediate support/resistance line at 45.82.

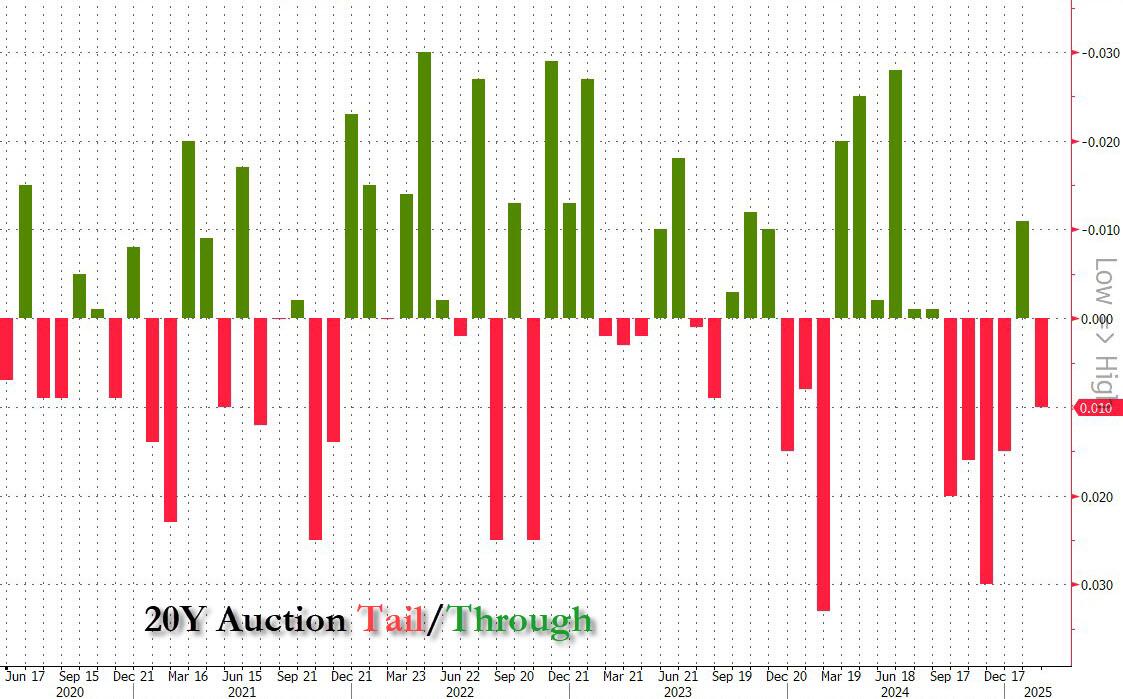

ZeroHedge reports, “In a day seeing another push higher in yields, moments ago the Treasury concluded the week’s lone coupon auction and it could have been better.

Pricing at a high yield of 4.830%, this was a 7bps drop from last month’s 4.90%, but while January’s auction stopped through the When Issued by 1.1bps, today we saw a 1.0bps tail to the 4.82% When Issued, the 5th tail in the last 6 auctions. ”

Zerohedge further explains, “Since the last FOMC meeting – on Jan 29th – the market has coped admirably well with the utter avalanche of headlines spewing from Washington (and around the world). Gold has been the standout choice while stocks, bonds, oil and the dollar are all about flat…

Source: Bloomberg

The macro data has been a nightmare (for The Fed) with stagflationary impulses clear as growth surprises have been to the downside while inflation surprises have soared to the upside…”

Gold futures ripped to the upside at 2972.91 this morning, then immediately reversed back down. Should it decline beneath 2933.00, it may have formed a key reversal. Today is the last day that gold could make an extended high, which caught me by surprise. However, further examination showed that the fractal lacked its final probe to a new high, which it accomplished today. Trump confirmed the Fort Knox audit.

ZeroHedge observes, ” Having started the ‘Audit Fort Knox’ discussion last week…

With our suggestion immediately going viral on X, with Sen. Rand Paul (R-KY) indicating he’s on board – replying to Musk with “Let’s do it.””

The Ag Index peaked yesterday in a burst of strength as it may have completed its Master Cycle high. The Master Cycle implies that the decline may last until the end of March, as will stocks. The downside target may be the declining trendline or the mid-Cycle support at 370.71.

ZeroHedge reveals, “Walmart exceeded Bloomberg analysts’ expectations for fourth-quarter US comparable sales and adjusted earnings per share. However, its first-quarter and full-year profit guidance missed, citing ongoing pressure from its product mix and an uncertain economic environment. Shares are down nearly 8% in premarket trading as the one-year non-stop rally hits a wall.

The discount retailer and the nation’s largest grocer—recognized by Goldman as offering the best prices for US consumers—reported a 20% surge in e-commerce sales for the holiday quarter. The results included $180.6 billion in total revenue and $7.9 billion in operating income, exceeding Wall Street expectations.”