The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen

8:45 am

Good Morning!

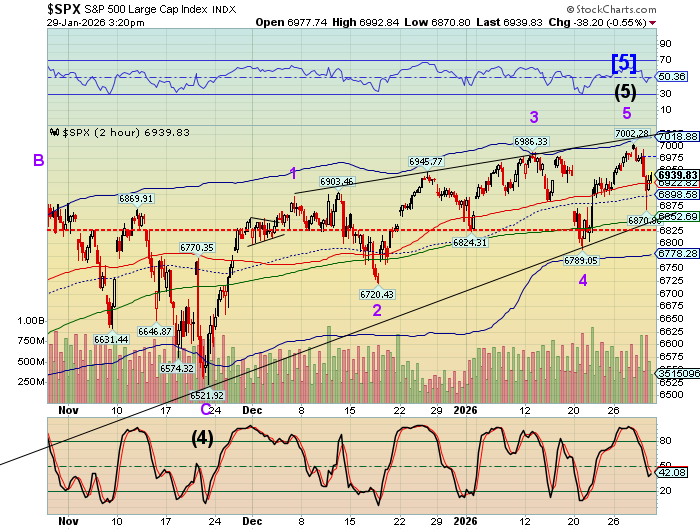

SPX futures probed Cyclical resistance at 7010.00 this morning, rising to a high at 7014.80. Whether it rises above 7000.00 in the regular session remains to be seen. There is a fractal limitation for this rally near 7050.00, but that does not seem to be a target today. Trump celebrated the SPX topping 7000.00 this morning, but a gamma wall lurks above 7030.00. The probability of a Key Reversal is high in the next few days.

Everyone is max long, with leverage, expecting the Mag 7 to post blow-out earnings. NDX futures have reached 26225.00 this morning, exceeding the October 29 high at 26182.00.

Today’s options chain shows Max Pain at 6855.00. Long gamma prevails above 7000.00 while short gamma dominates beneath 6925.00.

ZeroHedge reports, “US equity futures are rallying into record territory, led by Tech as overnight earnings (ASML, SK Hynix, STX, TXN) boost the group and help fuel the AI trade, perhaps pausing the broadening theme. As of 8:00am ET S&P futures are up 0.2% pointing to a sixth-straight advance that would mark the longest winning run in almost seven months and will push the S&P 500 cash index above the 7,000 mark for the first time when US markets open…”

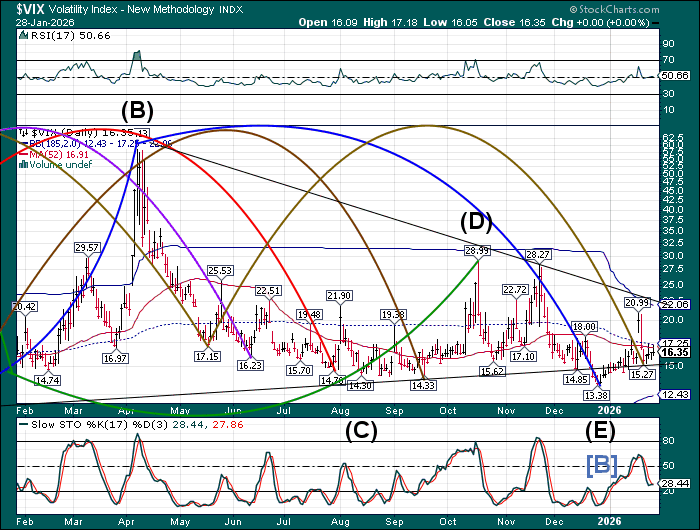

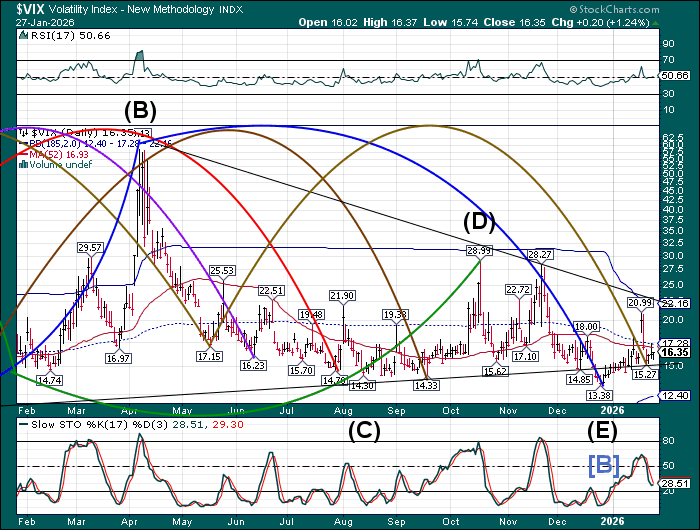

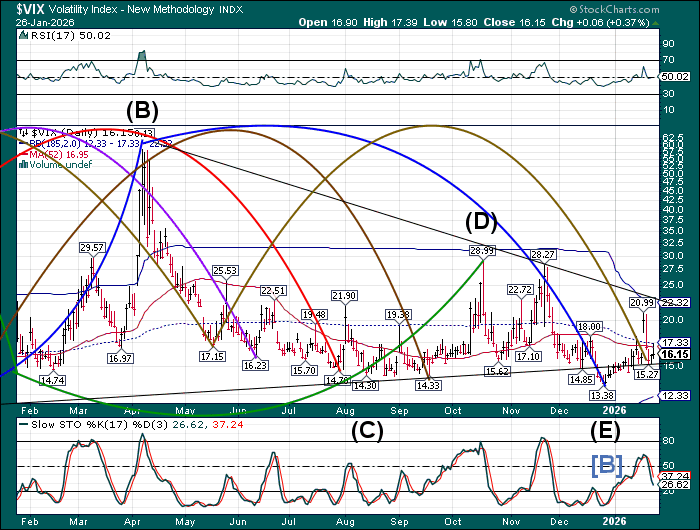

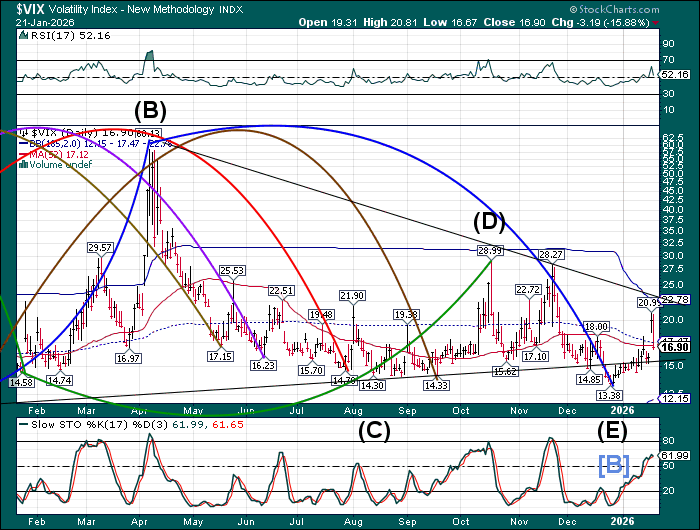

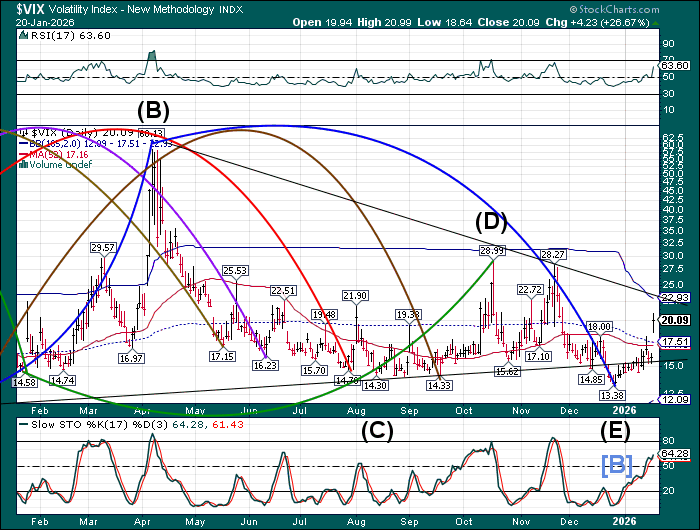

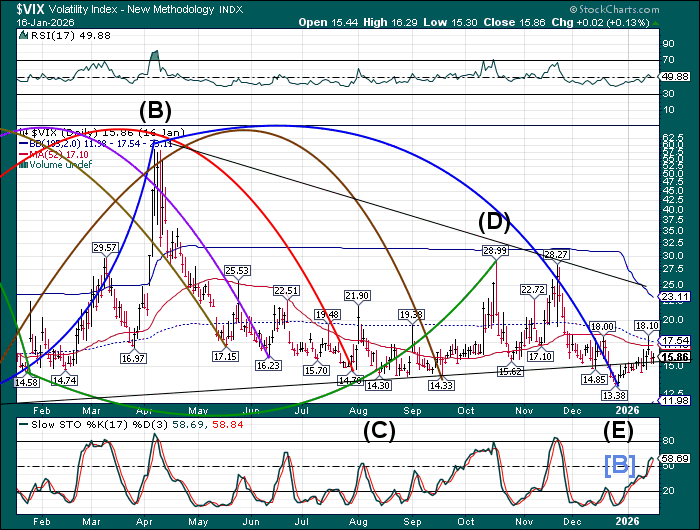

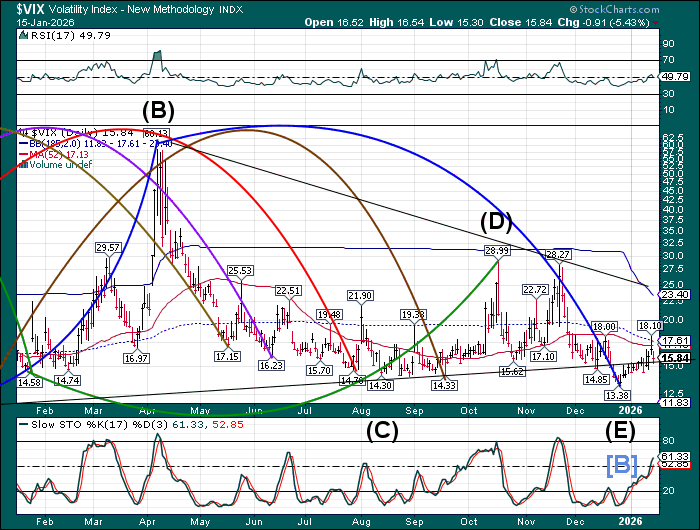

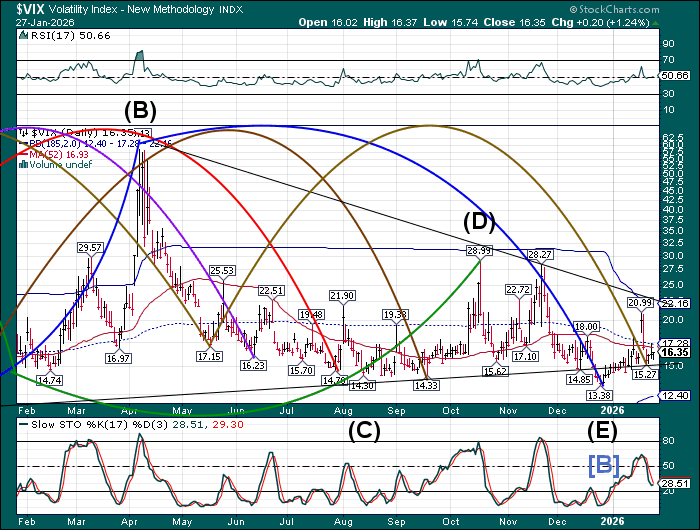

The premarket VIX rose to 16.52 this morning, remaining beneath the 52-day Moving Average at 16.93. The VIX may be poised to rally significantly starting this week, according to the Cycles Model. The December 24 low at 13.38 marks the beginning of the next phase of the uptrend established from a low of 10.62 in July 2024.

The February 4 options chain shows Max Pain at 16.00. Short gamma is waning, while long gamma is concentrated above 17.00, with a long call wall at 60.00.

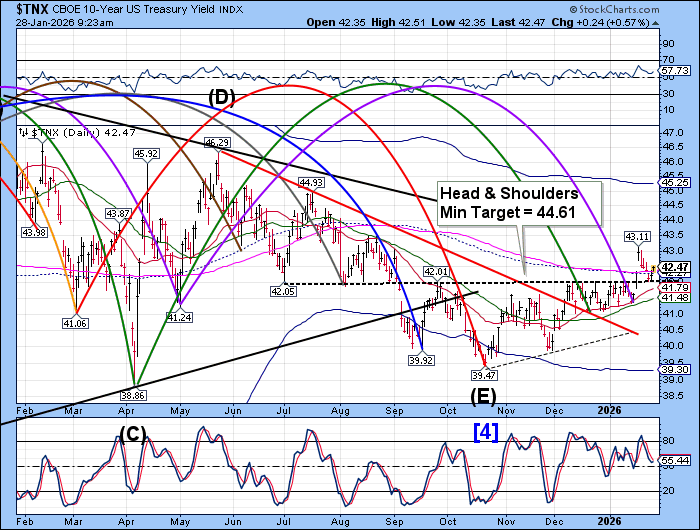

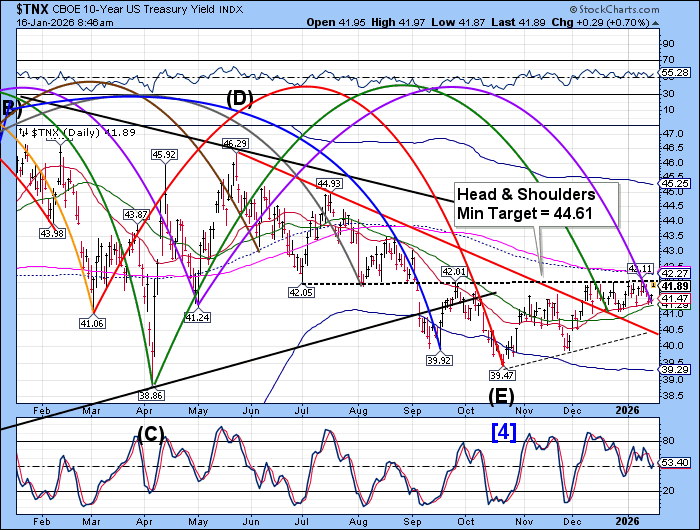

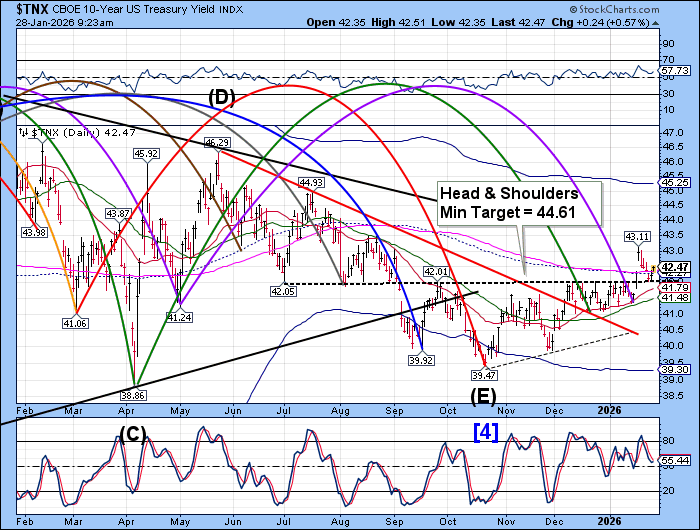

The US 10-year bond yield futures rose to 42.53 this morning, above the 200-day Moving Average at 42.34. This reiterates the buy signal. Trending strength picks up by the weekend while the Cycles Model indicates a rising yield to the week of February 16. The nearby target may be the Cycle Top resistance at 45.25. However, it may rise considerably more, once above that resistance.

ZeroHedge reports, “If yesterday’s 2Y auction was stellar, today’s 5Y sale was the opposite.

Just after 1pm, the US completed the sale of $70BN in 5Y paper at a high yield of 3.823%, up from 3.747% one month ago and the highest since July. It also tailed the When Issued 3.820% by 0.3bps, the 7th tail in the last 8 auctions.”

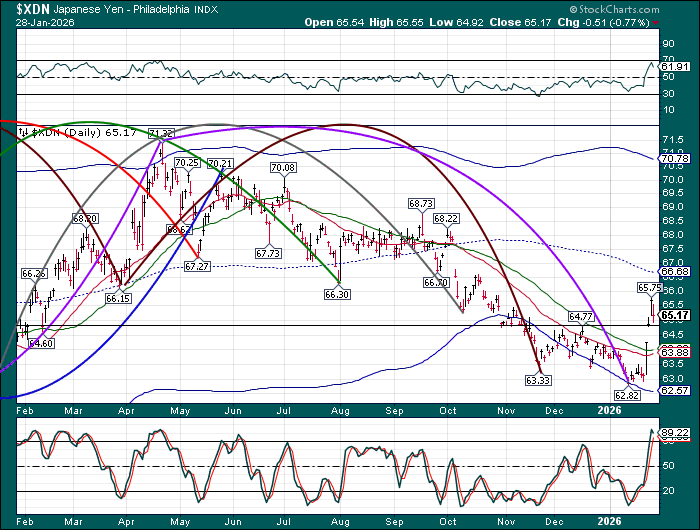

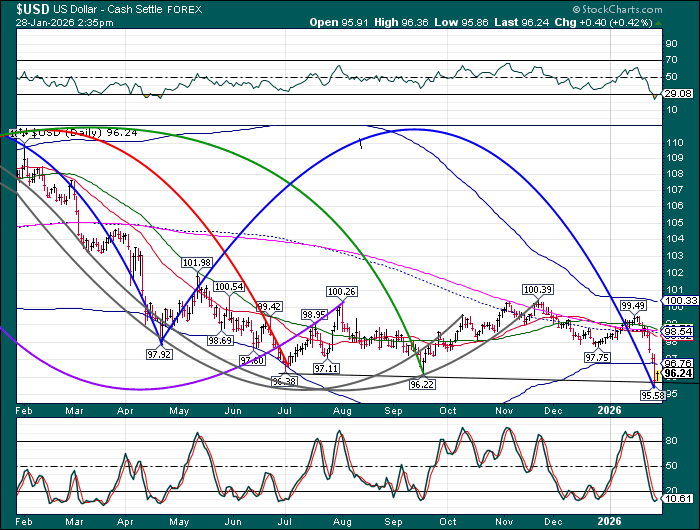

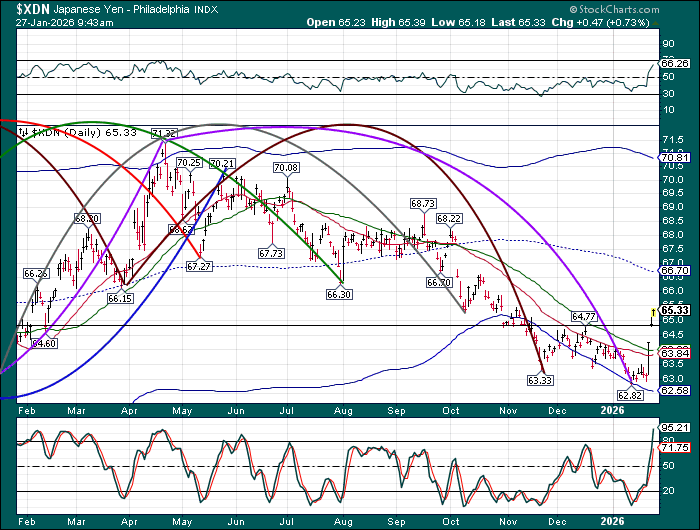

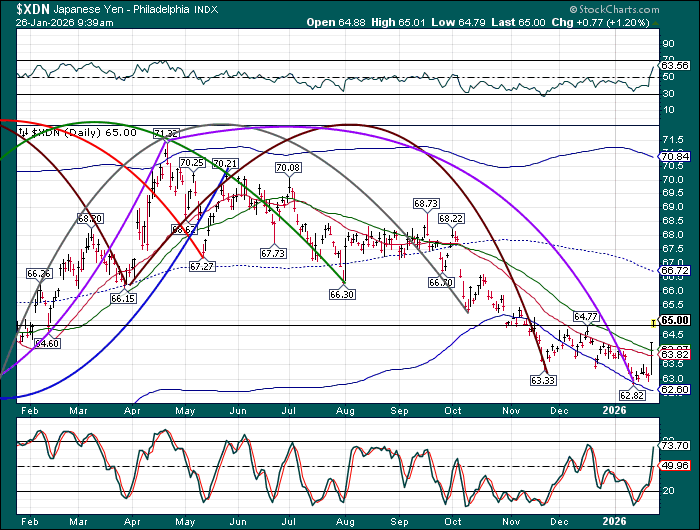

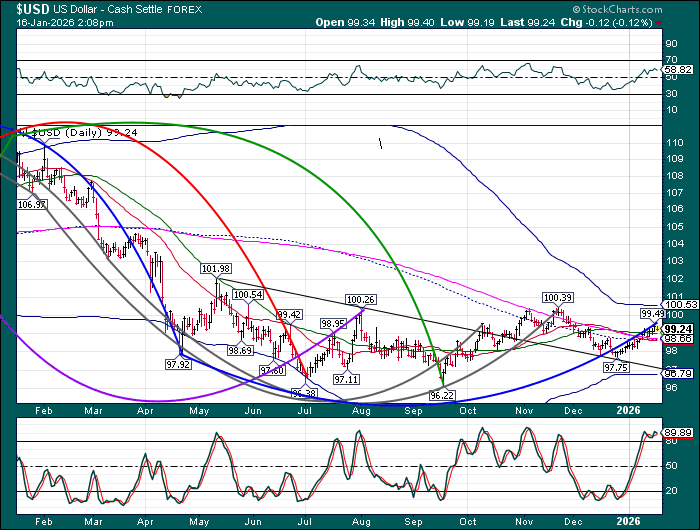

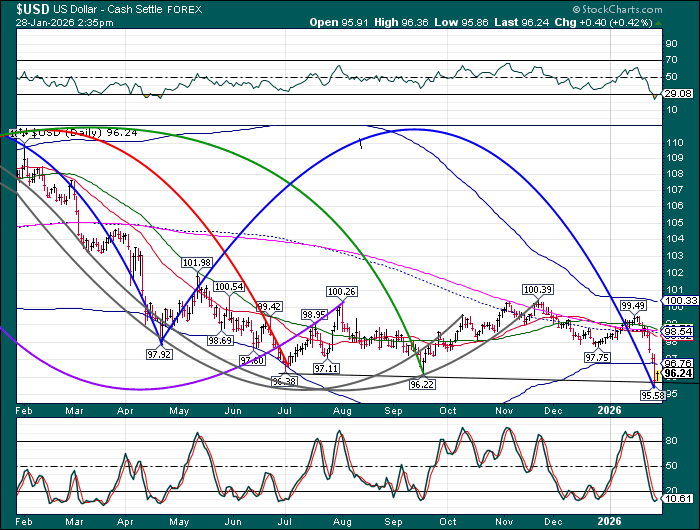

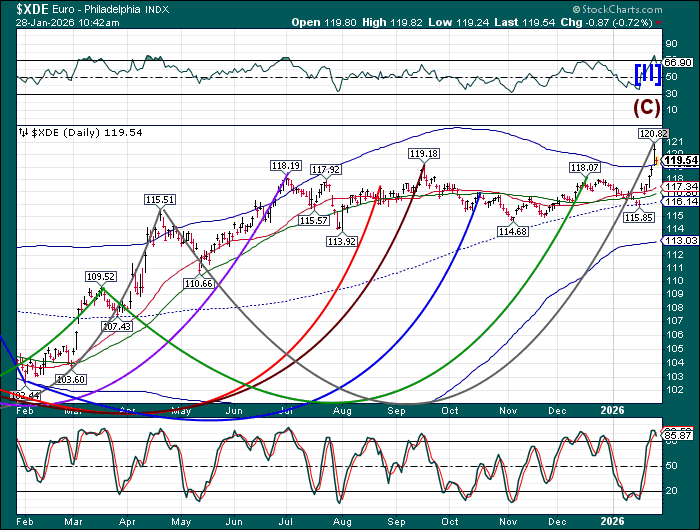

The USD index made a rebound from its Master Cycle low this morning, rising above the trendline at 95.80. This may be considered an aggressive buy signal, with confirmation above the lower trading band at 96.75. The expectation of dollar weakness may persist until it rises above its multiple resistance cluster around 98.54. Trump’s comments imply a tacit endorsement of a weaker USD. The primary reason may be that a weaker USD strengthens our balance of trade. However, that may not last as the Euro simultaneously made its Master Cycle high.

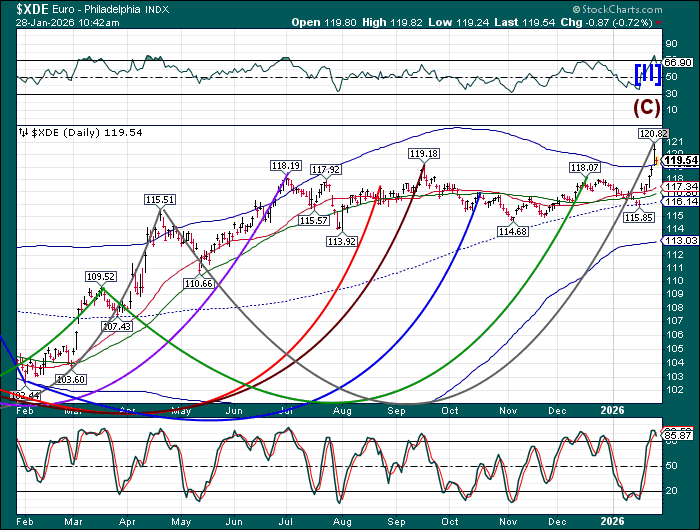

The Euro Index made its Master Cycle high yesterday, ending a year-long rally. It has been trending inversely to the USD during that time. The strength of the Euro belies the economic rot underneath. The politicians have run out of options, other than to blame the US for its woes. Many European companies have migrated to the US due to its economic advantages over the European economy. The Cycles Model indicates the plunge in the Euro starts today and strengthens over the weekend.

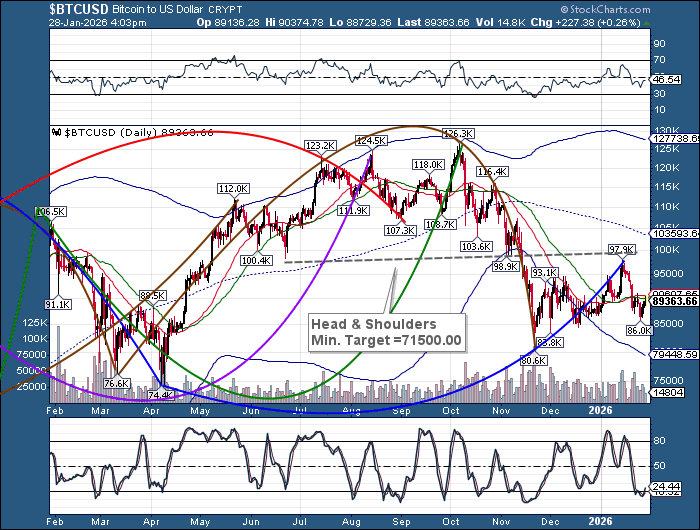

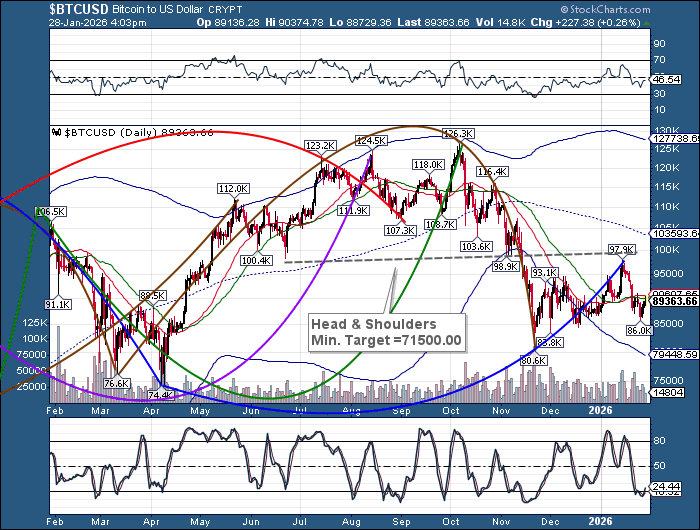

Bitcoin tested its 52-day Moving Average this morning at 90042.00 before pulling back. The Cycles Model suggests there may still be some life in the retracement. A possible extension to 92000.00 may be in order over the next few days.

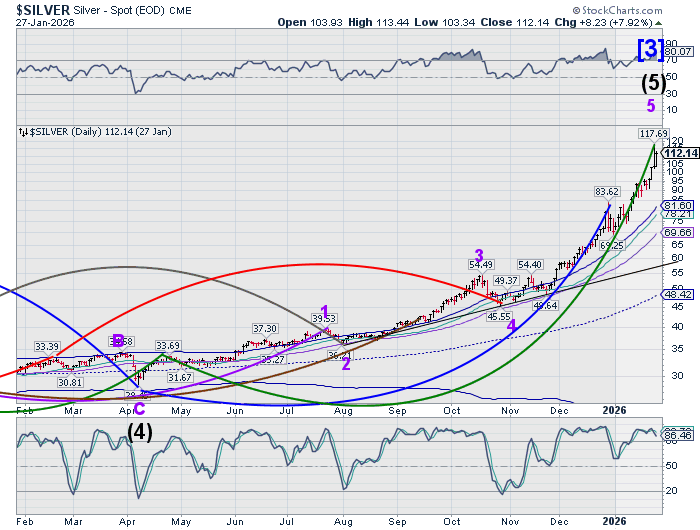

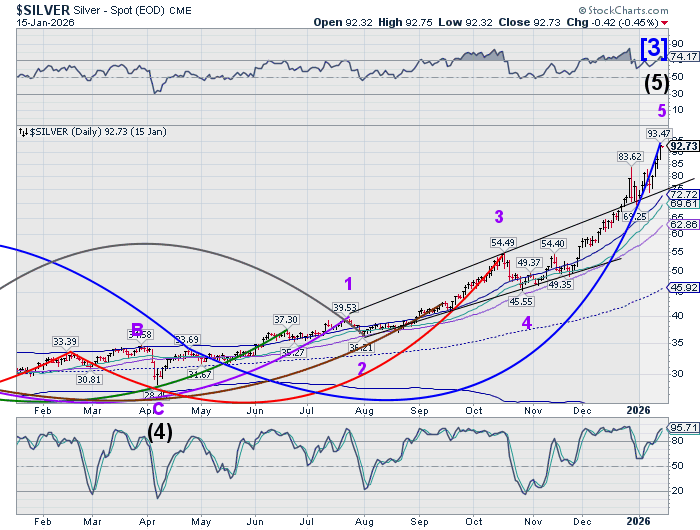

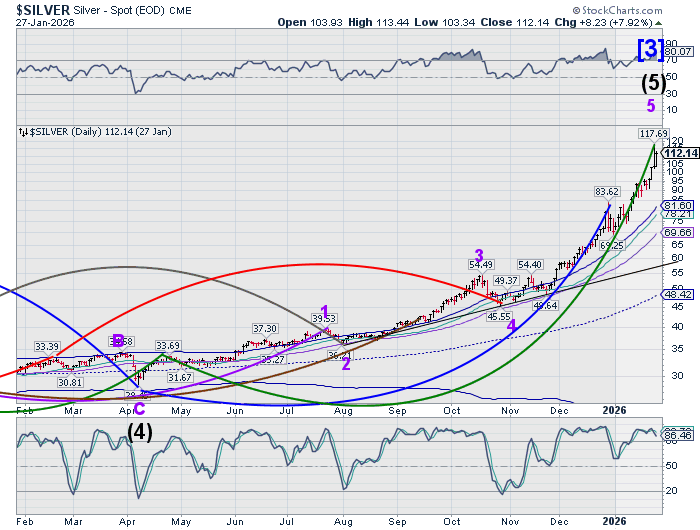

Silver futures rose to 116.11 this morning, short of its al-time high at 117.69. Traders remain convinced that silver may go higher, predicting a “failure to deliver” in March. However, the Cycles Model anticipates a substantial decline through early April. Things may not work out as the experts all agree.

ZeroHedge observes, “The rally in precious metals continues unabated. And, in particular, silver’s implied volatility has exploded since the beginning of November and is currently trading at 77.1%, a full 46 percentage points higher. Are we in a silver bubble? Brett looks at four critical factors, using options data from OptionMetrics and other data sources, that may hold the answer.”