The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

12:30 am

SPX has ;reached the trendline and Intermediate support at 6754.30 and may be ready to bounce. A partial retracement may develop throughout the afternoon, although selling pressure remains. The next bounce may be the 52-day Moving Average at 6699.00. SPX may be on an aggressive sell signal which may be confirmed beneath 6700.00. The tumble in equity markets is being led by the Nasdaq, specifically the Mega-Caps.

7:50 am

Good Morning!

Note: We are facing a planned power outage this morning. The morning report may be abbreviated.

SPX futures declined to 6828.60 after reaching its potential retracement limit. The Retracement shows a 9-point fractal, which suggests completion. Nearest support lies at 6744.51, where a sell signal may be acted upon. The government shutdown took 43 days and is likely to be repeated in January with more damaging results.

ZeroHedge reports, “Futures are slightly lower as the market sells the news that the US government has finally reopened, and as traders now seek to identify a near-term catalyst before NVDA’s Nov 19 earnings release while the data vacuum is likely to persist for at least several days.”

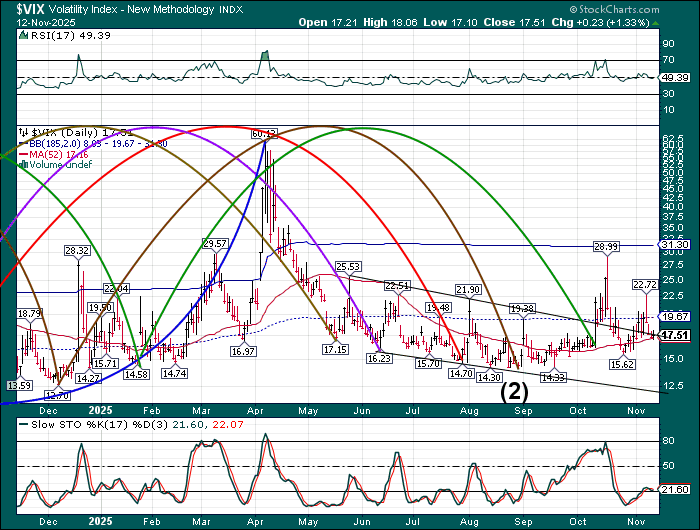

VIX futures rose above the 52-day and trendline to 18.06 this morning. The uptrend is not broken, allowing trending strength to grow over the next week. A strong panic Cycle may develop around monthly options expiration next week.

ZeroHedge remarks, “We’ll begin with the famous quote from economist John Maynard Keynes: “The market can stay irrational longer than you can stay solvent.”

It’s a reminder that even the smartest traders in the room, the ones who’ve built entire careers calling bubbles and shorting tops, can be steamrolled when markets detach from reality.”

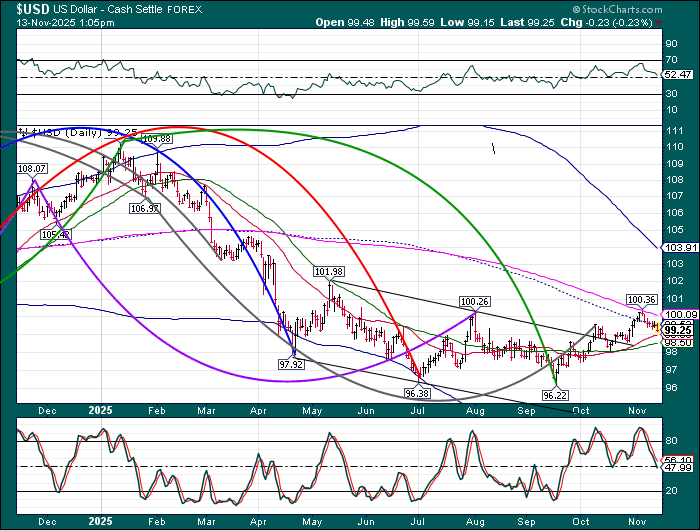

USD futures continue to decline as it retraces to support at the Intermediate level at 98.95. The 52-day Moving Average is at 98.50 as an alternate target. The retracement may be finished by the weekend.

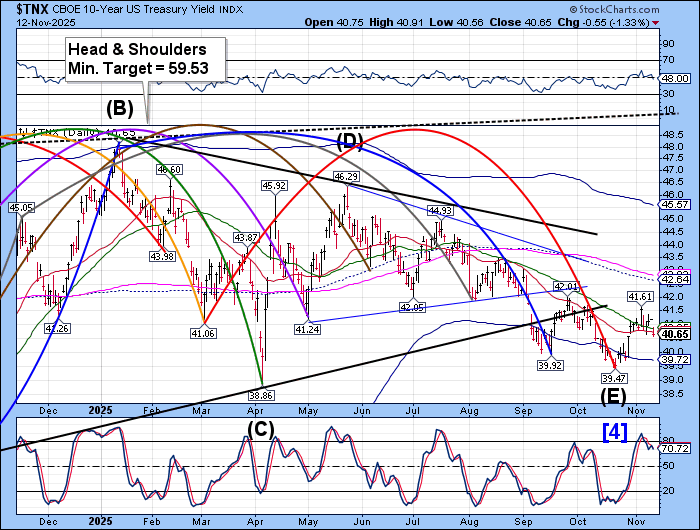

TNX is consolidating beneath the 52-day Moving Average at 40.95. It is making a Trading Cycle (minor) low before moving higher by next week. Money may be moving out of stocks to treasuries as a traditional safe haven. However it may not last, as the Cycles Model sugests higher 10-year rates to mid-December.

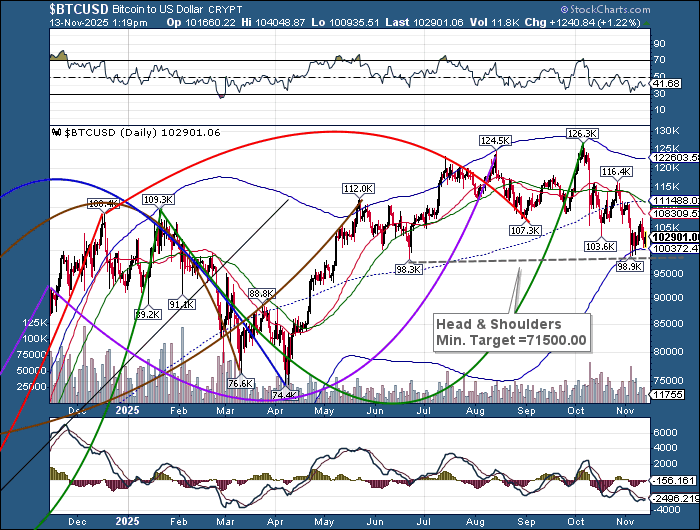

Bitcoin has resumed its decline toward the Head & Shoulders neckline. Its anticipated low may occur in the last week of November. Should it bounce at the neckline, we may see another bounce. However, once beneath the neckline, any bounce may be a test of the neckline.