The Lord’s Prayer

Our Father, who art in heaven, hallowed be thy name. Thy Kingdom come, Thy Will be done, on earth as it is in heaven. Give us this day our daily bread and forgive us our trespasses, as we forgive those who trespass against us. And lead us not into temptation, but deliver us from evil. Amen.

7:40 am

Good Morning!

SPX futures rose to 6876.80 this morning, nearing a natural limit on retracements. Comparison of past declines and recoveries may not be helpful for multiple reasons. First is the rule of alternation. All of the prior declines that were compared to resulted in a full recovery. There is an alternative. Second, the market may rhyme, but it does not repeat. Third, five and a half years of dips, then recoveries have produced a Pavlovian reaction in investors. The market doesn’t always recover, which may leave the majority on the wrong side. This is a time to be skeptical, since retracements may rise up to (but not above) the prior high, trapping the buy-the-dip crowd should an unexpected reversal prior to a full recovery occur. The Cycles Model leaves us with a potential double reversal that may go higher, but the fractal thus far leaves room for a reversal.

Today’s options chain shows Max Pain at 6830.00. Long gamma may prevail above 6850.00 while short gamma rules beneath 6800.00.

ZeroHedge reports, “US futures are higher as the US takes another step to reopen with a House vote (expected to pass early evening on Wednesday, with Trump’s approval. As of 8:15am, S&P futures are 0.4% higher with the mood buoyed by expectations of an imminent end to the government shutdown and a Fed rate cut next month.”

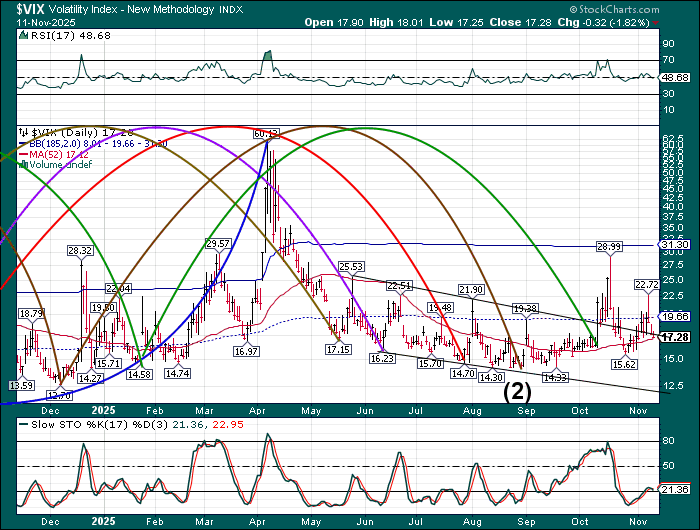

VIX futures declined to a morning low at 17.10 before a bounce, testing the 52-day Moving Average. VIX may have established its uptrend, albeit sluggishly. Today’s action may be a Trading Cycle low, with trending strength on a rebound next week. Today is weekly options expiration with Max Pain near 20.00.

The November 19 options chain shows Max Pain at 20.00. Short gamma shows puts are heavily laden between 15.00 and 18.00. Calls are coming alive at 22.00 and show heavy institutional involvement from 25.00 to 100.00.

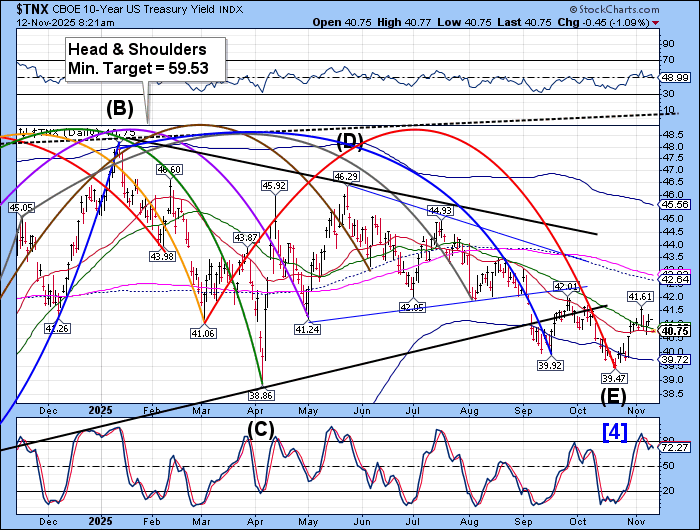

TNX has dipped beneath its 52-day Moving Average at 40.85. The Cycles Model shows a potential trading Cycle low this weekend, with recovery as the month progresses. This may indicate a preference for Treasuries over equities, as the traditional search for a safe haven may develop. The Cycles Model suggests a decline to the Cycle Bottom at 39.72 over the next week or so.

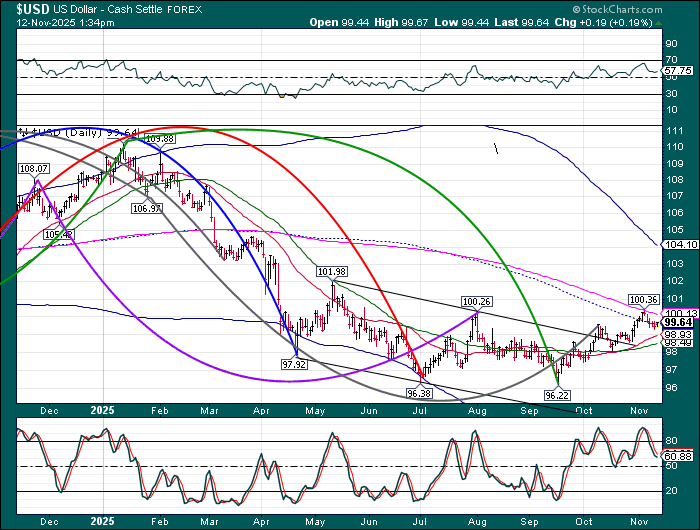

USD futures are consolidating at the mid-Cycle support at 99.61. USD is in a correction that may revisit the 52-day Moving Average at 98.49 in the next week. The Cycles Model indicates the rally may resume to the end of November.

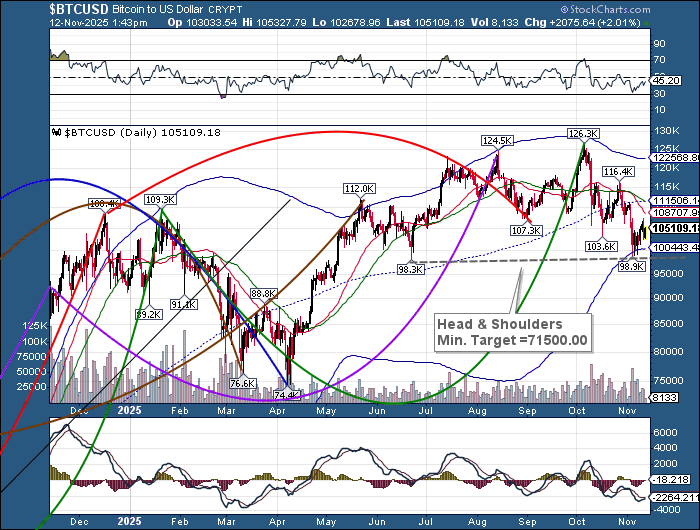

Bitcoin may be consolidating after a steep decline. The cycles Model indicates a potential resumption of the decline by early next week. The current Master Cycle ends in two weeks. The question is, will the decline venture beneath the Head & Shoulders neckline or stay above with another bounce?

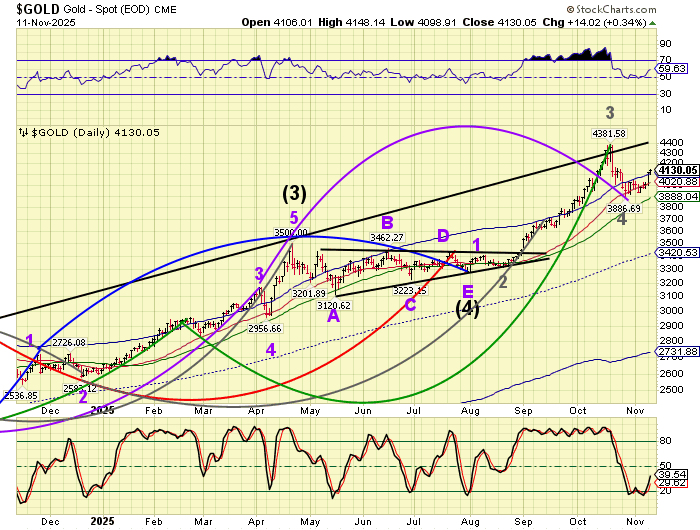

Gold futures are consolidating above the Cycle Top support at 4109.13 this morning. Trending strength may return next week with the rally resuming to mid-December.

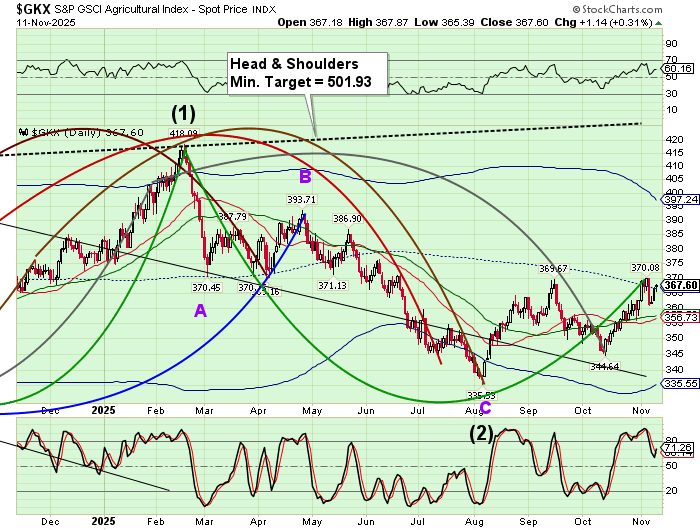

The Ag index may be due for a short-term correction down to the 52-day Moving Average at 357.68. Should it bounce at that level, the Cycles Model infers a resumption of the rally with strength next week. The current Master Cycle may last to late December.

TheEpochTimes comments, “President Trump is boldly facing the problem of high meat prices but also dealing with the financial strains on farmers themselves. The issue is reconciling the two. Lower prices are great for consumers but also add to the financial problems of small farmers. Gradually, Trump has come to the conclusion that the real bottleneck is with meatpackers themselves, which is one of the oldest corporate monopolies in U.S. history.”