11:40 am

While SPX hugs its Max Pain zone at 4375.00 to 4400.00, NDX is also walking a tightrope in the options arena. QQQ (359.95) is the best example where a slip may plunge it into the abyss. At the 360.00 strike, open interest in put contracs is 13,020 vs calls at 6580. Above that level is positive, while beneath 360.00 becomes deeply negative. Don’t be surprised to see these Max Pain levels maintained through the end of the day. However, accidents do happen. Meanwhile the NYSE Hi-Lo Index is at -4.00 and the NDX Hi-Lo Index is at -40.00.

The dealers are hoping that pensions will ante up at the table for quarter-end rebalancing.

ZeroHedge observes, “With month- and quarter-end on deck, Goldman’s theoretical, “model-based” estimates are for a net $14 billion of US equities to buy from US pensions given the moves in equities and bonds over the month and quarter.

How does this stack up vs history? According to Goldman’s Gillian Hood, this ranks in the 36th percentile amongst all buy and sell estimates in absolute dollar value over the past three years. In absolute terms, this falls below the three year average absolute dollar value of $26bn worth of equities to be rebalanced.”

7:55 am

Good Morning!

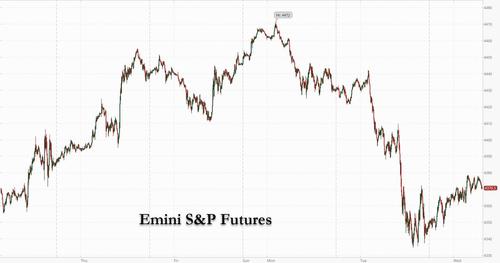

SPX futures appear to have completed Wave [c] of 2 this morning just shy of the 38.2% retracement level at 4391.05. It is unclear whether another attempt at retracement may be made at the open. While futures are still positive, negative gamma prevails for today’s options expiration. While open interest in today’s options remains neutral at 4400.00, it becomes progressively more negative the further south that prices go. Open interest in puts outnumber calls by 1750 at 4350.00 and outnumber calls by over 2000 at 4325.00. Puts have the upper hand by 5000 contracts at 4300.00.

In an event that largely goes unnoticed, the La Palma Volcano is having increasing tremors and quakes along with stronger eruptions that may further destabilize the volcano. The implication is a possible collapse into the Atlantic with knock-on results for the East Coast of the United States.

ZeroHedge reports, “U.S. index futures rebounded on Tuesday from Monday’s stagflation-fear driven rout as an increase in Treasury yields abated and the greenback dropped from a 10 month high while Brent crude dropped from a 3 year high of $80/barrel after API showed a surprise stockpile build across all products.

One day after one of Wall Street’s worst selloff of this year which saw the S&P’s biggest one-day drop since May, dip buyers made yet another another triumphal return to global markets, with Nasdaq 100 futures climbing 130 points or 0.9% after the tech-heavy index tumbled the most since March on Tuesday as U.S. Treasury yields rose on tapering and stagflationconcerns. S&P 500 futures rose 28 points or 0.6% after the underlying gauge also slumped amid mounting concern over the debt-ceiling impasse in Washington.”

The NYSE Hi-Lo Index closed at 0.00 yesterday, confirming the sell signal. Internals are extremely weak. Unfortunately, the live quotes during market hours include ETFs that double and triple count individual stocks. They are removed in the after hours to obtain the correct count, which we see this morning.

VIX futures pulled back to 21.45 this morning but has recovered somewhat as I write. The Cycles Model indicates an increase in trending strength going into the weekend and lasting through mid week. This implies a breakout above the neckline and the follow-through rally that may match the June 2020 high at 44.44 over the next week.

TNX futures pulled back to 14.94 in the overnight session. The Cycles Model suggest a bit more of a pullback by the weekend, then a period of strength during the first half of next week. This may lead to a Master Cycle high by mid-October.

ZeroHedge observes, “Maybe the market has been too hypnotized by the promise of cheap free money flowing forever, or maybe it remembers how the Fed stepped in last March to ensure that nobody lost any money and thus nobody wants to sell this time, or maybe it is just too used to buying every single dip so that news of the Fed’s taper actually sent stocks higher. But all that may soon change, because as Deutsche Bank’s Jim Reid calculates in terms of global central bank hikes exceeding cuts, we are now at the highest differential for a decade on a rolling 12-month basis.

In other words, we are now entering the most aggressively global hiking cycle in a decade.”

USD futures not only broke out above its previous high at 93.75 but also broke above its Cycle Top resistance at 93.83 this morning. This is lending credence to the notion that the Master Cycle may be extending until the end of the week, in a period of strength. A probable target for this rally may be 94.79, the equivalent of the June 2020 high and the 38.2% retracement level for the decline which extended from January 2020 to February 12, 2021 (12.9 months).

The Sanghai Composite Index fell to to a low of 3518.04 during today’s session before it bounced back toward the 50-day Moving Average at 3542.11. It is on a confirmed sell signal with a projected decline that may last until the second week of October. The high in September missed the February high by 8 points, attesting to the great lengths the Bank of China went through to keep stocks elevated, to no avail.

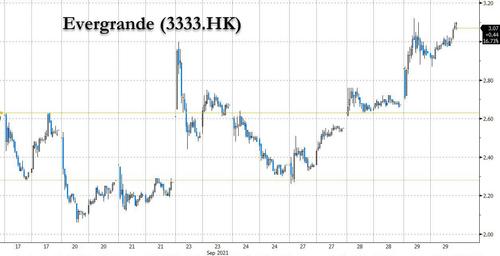

ZeroHedge reports, “China’s cash-strapped property giant Evergrande was on the verge of defaulting on a second bond on Wednesday despite agreeing to settle debt with a Chinese bank in a $1.5 billion stake divestment deal, a move which sent Evergrande’s worthless stock squeezing higher, now up 50% from a week ago.

Early on Wednesday, Evergrande said in an exchange filing that it would sell a 9.99 billion yuan ($1.5 billion) stake it owns in Shengjing Bank – its most valuable financial unit – to a state-owned asset management company. The bank, one of Evergrande’s main lenders, demanded all net proceeds from the sale go towards settling the developer’s debts with Shengjing.

“The company’s liquidity issue has adversely affected Shengjing Bank in a material way,” Evergrande said in the statement, adding that the introduction of the purchaser — state-owned Shenyang Shengjing Finance Investment Group Co. — will help to stabilize the bank’s operations.”

I appreciate, cause I found exactly what I was looking for. You’ve ended my 4 day long hunt! God Bless you man. Have a great day. Bye

I’m truly enjoying the design and layout of your blog. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a designer to create your theme? Fantastic work!

Hello! This post couldn’t be written any better! Reading this post reminds me of my old room mate! He always kept chatting about this. I will forward this page to him. Fairly certain he will have a good read. Many thanks for sharing!

My brother suggested I might like this web site. He was entirely right. This post truly made my day. You cann’t imagine simply how much time I had spent for this information! Thanks!

This is really fascinating, You are an overly professional blogger. I’ve joined your feed and look forward to in search of extra of your great post. Also, I’ve shared your web site in my social networks!

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

I was suggested this blog by my cousin. I’m not sure whether this post is written by him as nobody else know such detailed about my difficulty. You are wonderful! Thanks!